US stocks are unlikely to maintain their above-average performance over the next decade as investors plow into other assets, signaling an end to the S&P 500’s king-sized returns, Goldman Sachs Group strategists said Monday.

There is a 72% chance the S&P 500 Index will trail Treasury bonds and a 33% chance the stocks will lag inflation through 2034, the strategists said.“Investors should be prepared for equity returns during the next decade that are toward the lower end of their typical performance distribution,” the Goldman team wrote in a note.

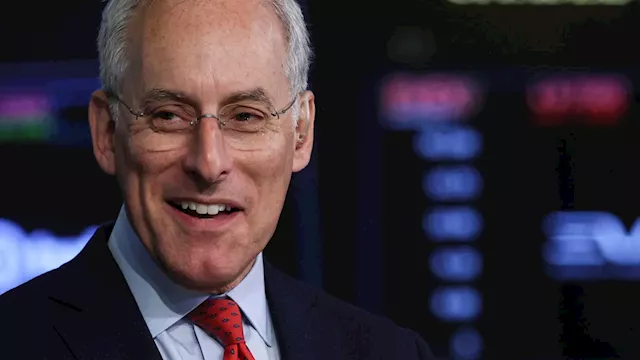

Mahoney Asset Management CEO Ken Mahoney said he agrees the benchmark index will be due for a down year, but he does not think it will come so soon.

الإمارات العربية المتحدة أحدث الأخبار, الإمارات العربية المتحدة عناوين

Similar News:يمكنك أيضًا قراءة قصص إخبارية مشابهة لهذه التي قمنا بجمعها من مصادر إخبارية أخرى.

Goldman Sachs raises S&P 500 EPS, index price target ahead of 3Q earningsGoldman Sachs raises S&P 500 EPS, index price target ahead of 3Q earnings

Goldman Sachs raises S&P 500 EPS, index price target ahead of 3Q earningsGoldman Sachs raises S&P 500 EPS, index price target ahead of 3Q earnings

اقرأ أكثر »

Goldman Sachs is getting more bullish about stocks, raises S&P 500 forecast to 6,000Goldman Sachs thinks the stars are aligning for the stock market through year-end and beyond.

Goldman Sachs is getting more bullish about stocks, raises S&P 500 forecast to 6,000Goldman Sachs thinks the stars are aligning for the stock market through year-end and beyond.

اقرأ أكثر »

Goldman Sachs Stock Drops Despite 54% Earnings Jump: Time to Buy?Stocks Analysis by ValueWalk (Dave Kovaleski) covering: Goldman Sachs Group Inc. Read ValueWalk (Dave Kovaleski)'s latest article on Investing.com

Goldman Sachs Stock Drops Despite 54% Earnings Jump: Time to Buy?Stocks Analysis by ValueWalk (Dave Kovaleski) covering: Goldman Sachs Group Inc. Read ValueWalk (Dave Kovaleski)'s latest article on Investing.com

اقرأ أكثر »