U.S. stocks plunged to one of their worst days of the year on Wednesday after the Federal Reserve hinted at delivering fewer interest rate cuts in 2025 than previously anticipated. The S&P 500 dropped 2.9%, nearing its biggest decline for the year, while the Dow Jones Industrial Average plummeted 1,123 points, or 2.6%, and the Nasdaq composite slid 3.6%. The Fed reduced its benchmark interest rate for the third time this year, continuing its aggressive rate cuts initiated in September.

While this reduction was widely anticipated, the key focus was on the extent of future cuts in 2025. Wall Street had been buoyed by expectations of a series of rate cuts in 2025, contributing to the U.S. stock market's numerous all-time highs this year. However, Fed officials' projections indicated a median expectation of only two more cuts in 2025, representing a significant decrease from the four cuts projected three months ago. Fed Chair Jerome Powell acknowledged the transition to a new phase in the rate-cutting cycle. He cited the robust performance of the job market and recent upticks in inflation as reasons for the Fed's shift in stance.

Argentina Últimas Noticias, Argentina Titulares

Similar News:También puedes leer noticias similares a ésta que hemos recopilado de otras fuentes de noticias.

US Stocks Dive on Fed's Signals of Fewer Rate CutsThe Federal Reserve's indication of fewer interest rate cuts in 2025 than previously anticipated sent US stocks plummeting. The S&P 500, Dow Jones Industrial Average, and Nasdaq composite all experienced significant losses.

US Stocks Dive on Fed's Signals of Fewer Rate CutsThe Federal Reserve's indication of fewer interest rate cuts in 2025 than previously anticipated sent US stocks plummeting. The S&P 500, Dow Jones Industrial Average, and Nasdaq composite all experienced significant losses.

Leer más »

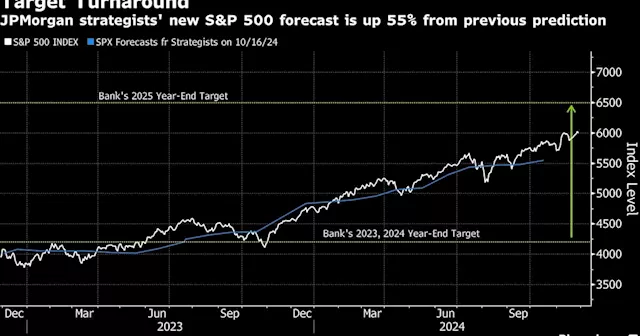

JPMorgan Turns Positive on US Stocks, Sees S&P 500 Advancing in 2025JPMorgan Chase & Co.’s equity strategy team, led for years by Marko Kolanovic until his departure earlier in 2024, has turned positive on US stocks.

JPMorgan Turns Positive on US Stocks, Sees S&P 500 Advancing in 2025JPMorgan Chase & Co.’s equity strategy team, led for years by Marko Kolanovic until his departure earlier in 2024, has turned positive on US stocks.

Leer más »

Dividend-paying stocks with upcoming spinoffs in 2025We are looking for sustainable dividends from stocks with spinoffs planned for 2025

Dividend-paying stocks with upcoming spinoffs in 2025We are looking for sustainable dividends from stocks with spinoffs planned for 2025

Leer más »

BlackRock bets on AI-driven stocks rally but U.S. debt clouds 2025 outlookFirm does not expect a large U.S. rate reduction

BlackRock bets on AI-driven stocks rally but U.S. debt clouds 2025 outlookFirm does not expect a large U.S. rate reduction

Leer más »