A pair of JPMorgan Chase & Co. strategists raised eyebrows earlier this month when they espoused seemingly contradictory market calls.

“ Years ago, market strategists recalled, it was more common for banks to enforce what was known as ‘the house view.’”In a post on X, the social-media site formerly known as Twitter, Tuttle Capital CEO Matthew Tuttle highlighted the contradiction with a guess at its cause and a smiley face. To be sure, CEOs contradicting their own economists and analysts isn’t uncommon on Wall Street. JPMorgan CEO Jamie Dimon made headlines last year for predicting an economic “hurricane” would batter the U.S. economy, a characterization that went beyond what JPMorgan’s economists were forecasting.

First, Wall Street failed to anticipate the inflationary shock that sent U.S. stocks and bonds tumbling in 2022. The S&P 500 SPX finished 2022 with a drop of 19.4%, according to FactSet data, its worst calendar-year performance since 2008. The Bloomberg Barclays U.S. Aggregate Bond Index U.K.:USAG, a benchmark for the U.S. bond market, endured its worst year since at least the 1970s, bond-market strategists said.

“MIFID II is a killer,” said Marvin Barth, former head of foreign-exchange and emerging-market macro strategy at Barclays PLC, during a call with MarketWatch. “It has undermined the whole business model.” “I guarantee you the clients only want to speak to analysts who are right,” Woo said. “They don’t care if the bank has a consistent view, a unified view. … They just want to know what this analyst thinks.”

Österreich Neuesten Nachrichten, Österreich Schlagzeilen

Similar News:Sie können auch ähnliche Nachrichten wie diese lesen, die wir aus anderen Nachrichtenquellen gesammelt haben.

Stock market today: Wall Street drops as faltering Chinese economy sets off global slideA sharp drop for Wall Street capped a day of declines worldwide after discouraging data on China raised worries about the global economy.

Stock market today: Wall Street drops as faltering Chinese economy sets off global slideA sharp drop for Wall Street capped a day of declines worldwide after discouraging data on China raised worries about the global economy.

Weiterlesen »

Stock market today: Wall Street rises in early trading, though bond yields remain highStocks are opening slightly higher on Wall Street following some encouraging profit reports from big companies.

Stock market today: Wall Street rises in early trading, though bond yields remain highStocks are opening slightly higher on Wall Street following some encouraging profit reports from big companies.

Weiterlesen »

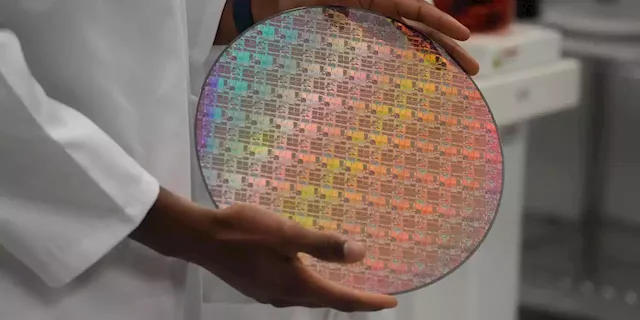

Applied Materials earnings, outlook top Wall Street expectations, and stock risesApplied Materials' stock rose after hours Thursday as both earnings and outlook for the maker of semiconductor-manufacturing equipment topped Wall Street...

Applied Materials earnings, outlook top Wall Street expectations, and stock risesApplied Materials' stock rose after hours Thursday as both earnings and outlook for the maker of semiconductor-manufacturing equipment topped Wall Street...

Weiterlesen »