Though high-quality stocks are a good bet to outperform low-quality stocks over the long term, I doubt investors’ need yet another ETF focused on high-quality stocks.

Though different advisers employ slightly different definitions of quality, there is general agreement that quality stocks are those that are highly profitable and have consistent earnings and healthy balance sheets. So-called “junk” stocks are at the opposite end of the quality spectrum. From mid-1957 through mid-2023—a 66-year period—AQR’s quality stock portfolio outperformed its junk stock portfolio by more than eight annualized percentage points: 11.9% to 3.7%.

Österreich Neuesten Nachrichten, Österreich Schlagzeilen

Similar News:Sie können auch ähnliche Nachrichten wie diese lesen, die wir aus anderen Nachrichtenquellen gesammelt haben.

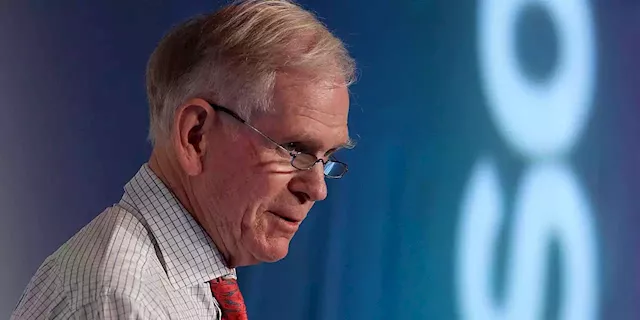

Jeremy Grantham’s GMO plans its first ETF, a fund that will target quality stocksLegendary investor Jeremy Grantham’s GMO is planning to offer an exchange-traded fund that will invest in U.S. quality stocks, the firm’s first ETF as it...

Jeremy Grantham’s GMO plans its first ETF, a fund that will target quality stocksLegendary investor Jeremy Grantham’s GMO is planning to offer an exchange-traded fund that will invest in U.S. quality stocks, the firm’s first ETF as it...

Weiterlesen »

Crypto funds return to outflows amid market crash, bitcoin ETF sentimentCrypto investment products at asset managers such as Grayscale, Bitwise and ProShares returned to outflows of $55 million last week.

Crypto funds return to outflows amid market crash, bitcoin ETF sentimentCrypto investment products at asset managers such as Grayscale, Bitwise and ProShares returned to outflows of $55 million last week.

Weiterlesen »