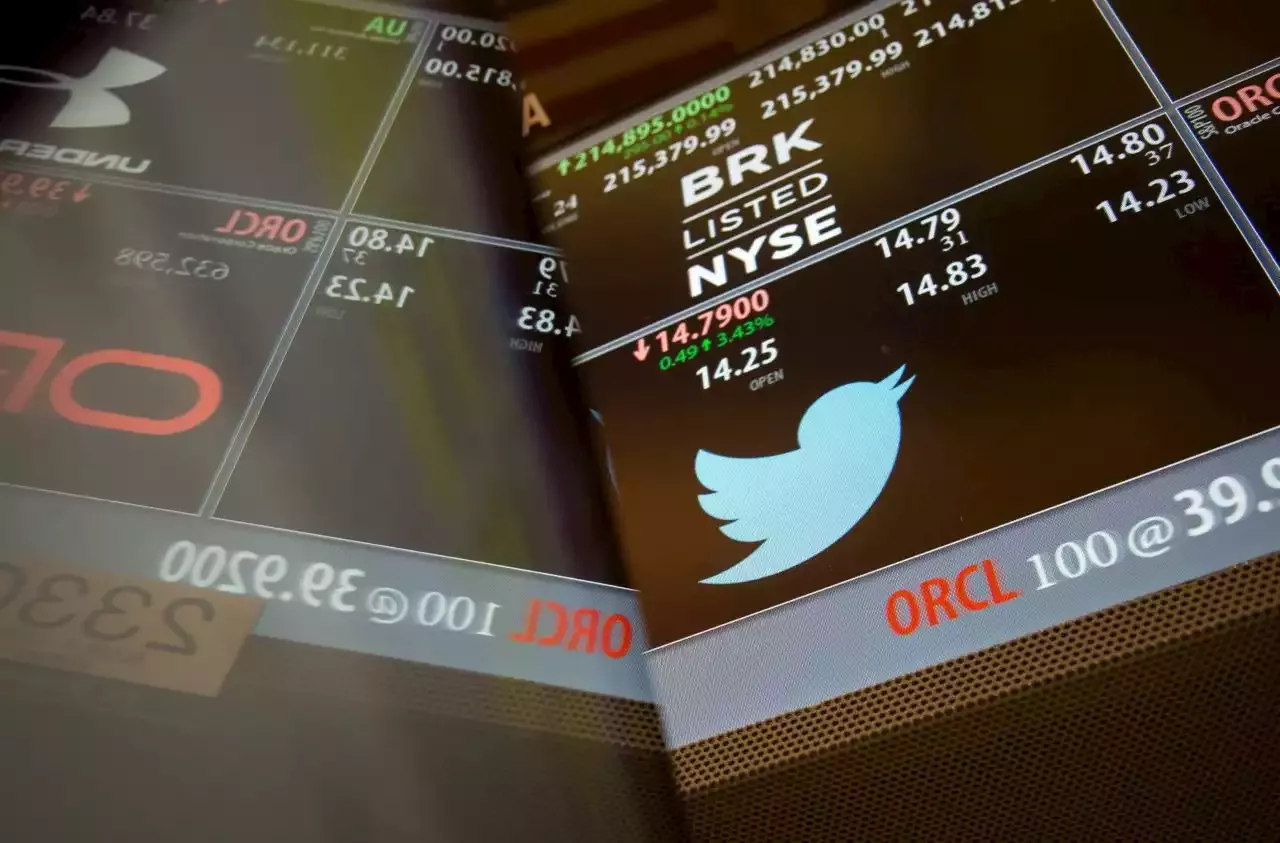

While the Musk-Twitter fight has the market transfixed, a bigger issue for the M&A industry is the generally challenging backdrop for deals. With volatility continuing and interest rates rising, a slowdown is expected in the third quarter with the possibility of more transactions being pulled, a Bloomberg News survey of 16 M&A trading desks, fund managers and analysts, found. They named Seagen Inc. as the most likely takeover candidate in the next three months.

Among the deals considered most at risk were Nielsen Holdings Plc, Citrix Systems Inc and Tenneco Inc, survey respondents said. They are in the most bruised corner of the tech sector and have private equity buyers, who tend to be more focused on financials than strategic buyers, who are more concerned about regulatory and antitrust issues.

I have always hated Bitcoin and thought it was a scam until a friend referred me to Mike_Rosehart , I made my first withdrawal of R100,000 in 2 weeks thanks to Mike_Rosehart.

Belgique Dernières Nouvelles, Belgique Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

Business Maverick: Twitter Shares Sink, With Legal Battle Ahead as Elon Musk Walks AwayTwitter Inc. shares tumbled Monday after Elon Musk walked away from his $44 billion deal to buy the company, setting the scene for a disruptive legal battle. 54 but who's counting... I have always hated Bitcoin and thought it was a scam until a friend referred me to Mike_Rosehart , I made my first withdrawal of R100,000 in 2 weeks thanks to Mike_Rosehart I acted on faith, I'm now reaping the reward of that bold step and making more money than I couldn't even imagine all thanks to an amazing woman fx_sarah_jeff

Business Maverick: Twitter Shares Sink, With Legal Battle Ahead as Elon Musk Walks AwayTwitter Inc. shares tumbled Monday after Elon Musk walked away from his $44 billion deal to buy the company, setting the scene for a disruptive legal battle. 54 but who's counting... I have always hated Bitcoin and thought it was a scam until a friend referred me to Mike_Rosehart , I made my first withdrawal of R100,000 in 2 weeks thanks to Mike_Rosehart I acted on faith, I'm now reaping the reward of that bold step and making more money than I couldn't even imagine all thanks to an amazing woman fx_sarah_jeff

Lire la suite »