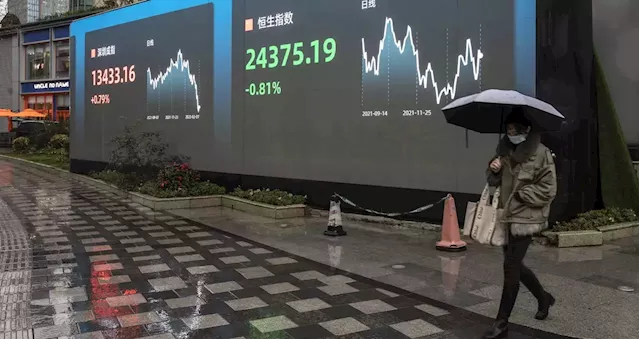

Shares rose in Hong Kong and mainland China as a poor reading for retail sales underscored how much the economy has to benefit from the government’s recent efforts to recalibrate Covid curbs. A gauge of Asian equities headed for the highest in two months and contracts for the S&P 500 and the Nasdaq 100 were up.

The dollar and Treasury yields held their gains, with the 10-year rate around 3.86% after Federal Reserve speakers highlighted resolve to be persistent until inflation heads back down to levels consistent with the 2% target. Fed vice chair Lael Brainard briefly buoyed sentiment after she said it would be appropriate “soon” to“It’s certainly a time to be thinking about a recovery regime unfolding for markets,” Kristina Hooper, chief global market strategist at Invesco, said on Bloomberg Radio.

The Hang Seng China Enterprises Index has now risen more than 20% from a low on 31 October, meeting the common definition of a technical bull market. The easing of some virus controls and sweeping measures to support the property market have given traders confidence that Beijing is finally taking concrete steps to tackle the two biggest sore points for the economy and markets.

Despite these positive signs in Asia and indications of moderating inflation in the US, higher borrowing costs are a headwind for the global economy. The cumulative impact of prior interest-rate hikes will continue to weigh on growth and corporate profits, according to Mark Haefele, chief investment officer at UBS Global Wealth Management, who recommends that investors take a defensive position.in the three months through September, as consumers spent less amid a resurgence of Covid cases and the weak yen battered trade. The yen traded around 140 versus the dollar on Tuesday, having strengthened from the 150 level seen in October.

Belgique Dernières Nouvelles, Belgique Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

International Finance: Asian equities led higher by China on policy moves: markets wrapAsian equities advanced on Monday with a tailwind from the biggest weekly gain in US stocks since June and China’s policy shifts on Covid curbs and the property sector.

International Finance: Asian equities led higher by China on policy moves: markets wrapAsian equities advanced on Monday with a tailwind from the biggest weekly gain in US stocks since June and China’s policy shifts on Covid curbs and the property sector.

Lire la suite »