The U.S. dollar may be losing its appeal as one of the few reliable safe-haven assets in times of economic and geopolitical uncertainty after an 18 month rally, but a further fall by the currency could fuel a 2023 stock-market rally, market analysts said.

The dollar index, a gauge of the greenback’s strength against a basket of six major currencies, fell 0.9% to 101.04 on Wednesday afternoon, its lowest level since April 25, Dow Jones Market Data show. John Luke Tyner, portfolio manager and fixed-income analyst at Aptus Capital Advisors, said the main reason for the dollar outperforming the rest of the world last year was that the Federal Reserve was leading global central banks in this interest-rate hiking cycle. Now other central banks are playing catch-up.

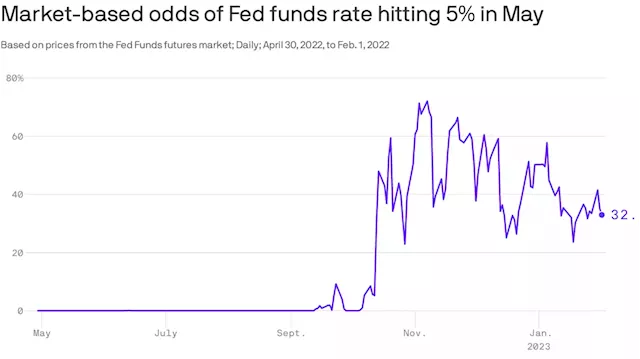

However, while Powell and his colleagues are determined to keep interest rates elevated “for some time,” investors don’t seem to believe that they will stick with elevated rate hikes in 2023. Traders projected a 52% probability that the rate will peak at 5-5.25% by May or June, followed by almost 50 basis points of cuts by year-end, according to the CME’s FedWatch tool.

Frieda acknowledged the possibility that inflation could prove stickier in the U.S. than in other advanced economies, or that monetary policy may tight for an extended period. That would suggest the risk premium in the dollar market could still remains sizable, but “these premiums could decline further as shocks recede and evidence builds that last year’s surge in inflation is well and truly improving and abating.

Further U.S. Dollar weakness is a certainty!

like I said most Asia will move away from American Banking system , leaving big holes

Belgique Dernières Nouvelles, Belgique Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

Here's what's driving 2023's stock market rallyMarkets have turned downright frisky, as the fear of endless Federal Reserve rate hikes fades. Day late.

Here's what's driving 2023's stock market rallyMarkets have turned downright frisky, as the fear of endless Federal Reserve rate hikes fades. Day late.

Lire la suite »

Despite 'extraordinary' 2023 rally, stocks are just OK: BlackRock bond chiefDespite 'extraordinary' 2023 rally, stocks are just OK, BlackRock's bond chief says

Lire la suite »