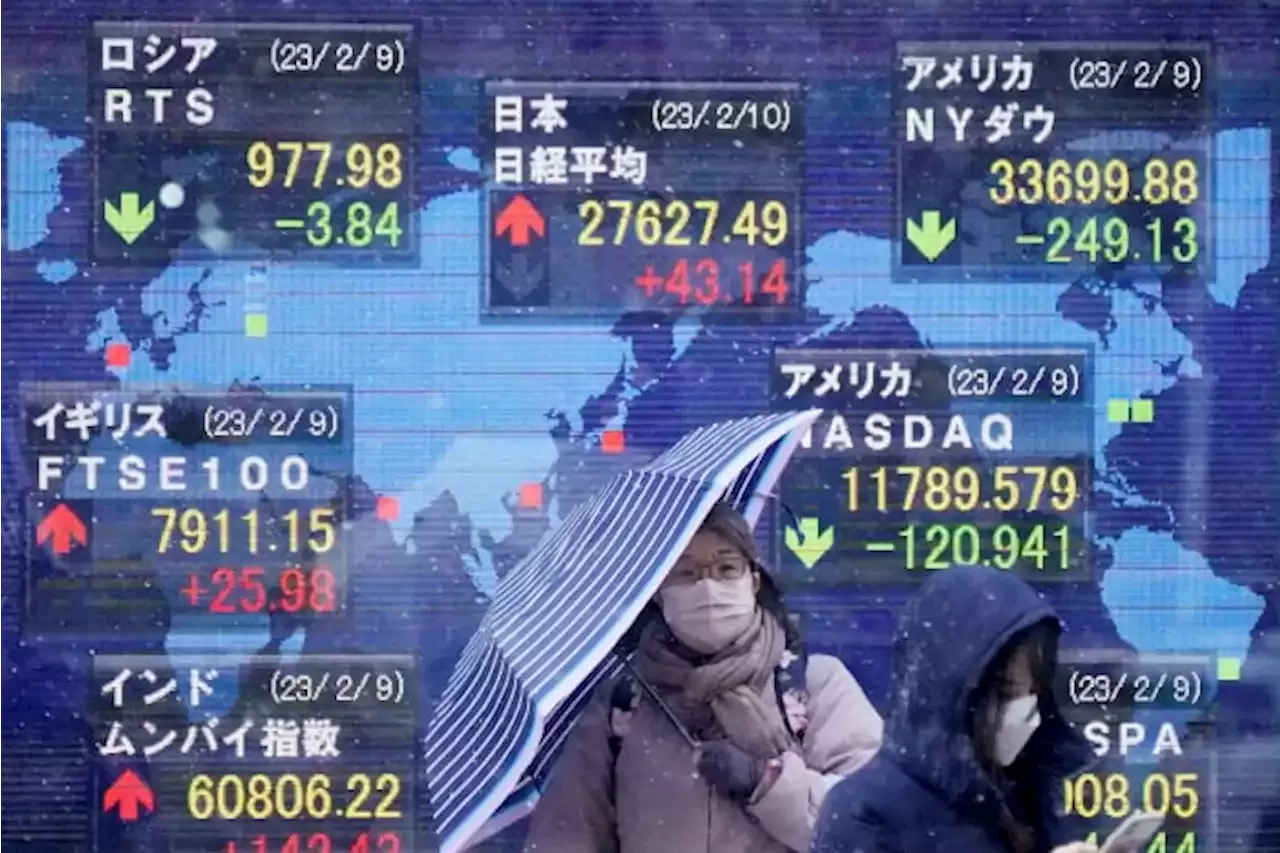

People stand in the snow near an electronic stock board showing Japan's Nikkei 225 and other countries indexes at a securities firm Friday, Feb. 10, 2023, in Tokyo. Asian shares were mostly lower on Friday after Wall Street retreated for a second day as market watchers considered earnings reports and various indicators about whether inflation is waning in the U.S. and elsewhere. –

Producer prices fell 0.8% in January after a 0.7% decline the month before. Consumer price inflation rose to 2.1% from a 1.8% climb in December. Japan's benchmark Nikkei 225 added 0.3% to finish at 27,670.98. Australia's S&P/ASX 200 slipped 0.8% to 7,433.70. South Korea's Kospi declined 0.5% to 2,469.73. Hong Kong's Hang Seng shed 2.0% to 21,190.42, while the Shanghai Composite was down 0.3% at 3,260.67. Shares in Mumbai and Taiwan also declined.

“Now that markets have absorbed hawkish reactions by central bankers after the latest rate announcement and data releases, the focus will shift back to data,” Francesco Pesole, a strategist at ING, said in a report.

Belgique Dernières Nouvelles, Belgique Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

Awful stock market analysts, Wall Street economists are costing investors moneyI've been a Wall Street economist for 15 years. The deluge of crappy analysis being spouted by so-called 'experts' has never been worse. Thank you for saying this It could be said for journalism in general; political, financial, social, education, …, every aspect Folk chase the dollar their media business is after and not the integrity of their chosen field If you can convince people the market is going to crash, the market is going to crash. Sound like the media also.

Lire la suite »

Fox Corp. Earnings: What Wall Street Likes About the Murdochs’ Latest MovesA plan for an increased stock buyback program as well as higher advertising revenue played well with investors and finance experts.

Fox Corp. Earnings: What Wall Street Likes About the Murdochs’ Latest MovesA plan for an increased stock buyback program as well as higher advertising revenue played well with investors and finance experts.

Lire la suite »

VF in Wall Street Limbo as Company ResetsThe parent to Vans, Supreme and The North Face is trying to get its groove back under interim CEO Benno Dorer.

VF in Wall Street Limbo as Company ResetsThe parent to Vans, Supreme and The North Face is trying to get its groove back under interim CEO Benno Dorer.

Lire la suite »