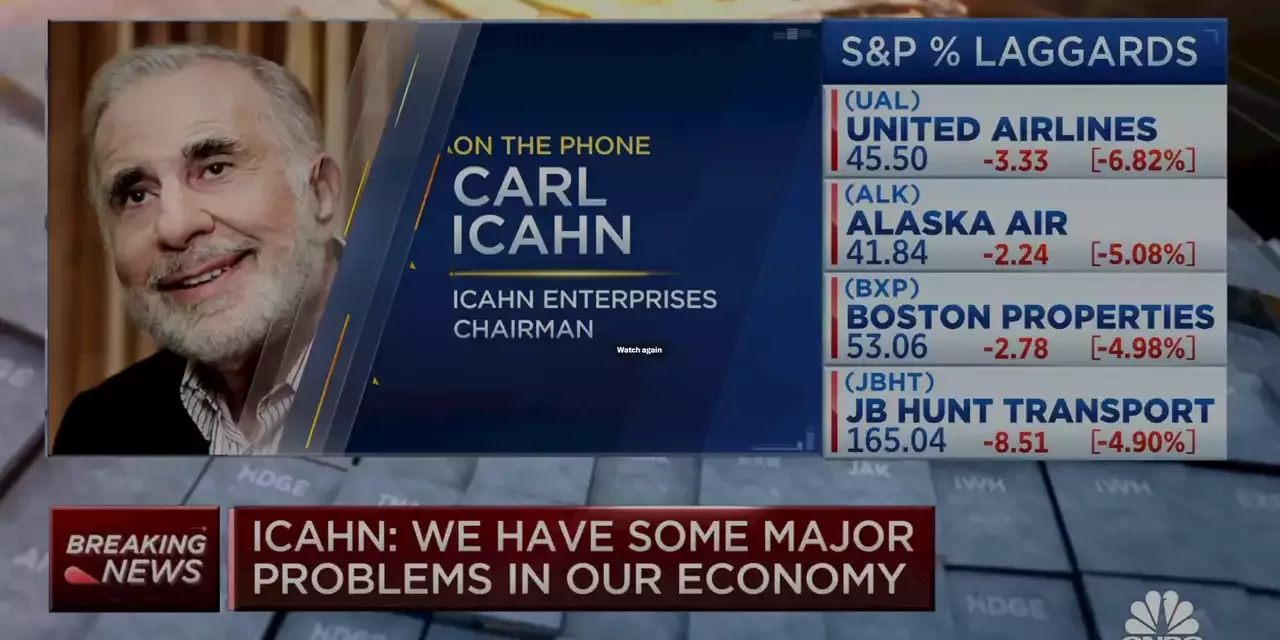

Icahn Enterprises LP shares fell another 20% on Wednesday, extending their prior-day losses in the continued fallout from a short seller’s report that was critical of the investment arm of activist investor Carl Icahn.

The stock closed down 20% on Tuesday to notch its biggest one-day decline on record after short seller Hindenburg Research accused the company of inflating its value. The market-cap loss was about $4 billion. If today’s slide holds, it will cost another $2.6 billion in market cap. “We stand by our public disclosures and we believe that [Icahn Enterprises’] performance will speak for itself over the long term as it always has,” Icahn said in the statement.

Icahn Enterprises offers exposure to Icahn’s personal portfolio of public and private companies, including petroleum refineries, car-parts makers, food-packaging companies and real estate.

Belgique Dernières Nouvelles, Belgique Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

Icahn Enterprises stock skids lower as short seller Hindenburg puts Carl Icahn's company in crosshairsHindenburg Research said it is betting against Icahn Enterprises and contends the company is overvalued compared with peers.

Icahn Enterprises stock skids lower as short seller Hindenburg puts Carl Icahn's company in crosshairsHindenburg Research said it is betting against Icahn Enterprises and contends the company is overvalued compared with peers.

Lire la suite »

Hindenburg Research goes after Carl Icahn in latest campaign for market-moving short sellerThe Nathan Anderson-led firm took a short position against Icahn Enterprises, alleging 'inflated' asset valuations, among other reasons.

Hindenburg Research goes after Carl Icahn in latest campaign for market-moving short sellerThe Nathan Anderson-led firm took a short position against Icahn Enterprises, alleging 'inflated' asset valuations, among other reasons.

Lire la suite »