The Fed left its benchmark funds rate window at 5-5.25%, as expected, yet committee members surprised markets by projecting two more 25 basis point hikes this year, sending short-term U.S. yields higher and closing out bets on any cuts in 2023., meanwhile, is expected to deliver its eighth straight rate hike later in the day which will take borrowing costs to two-decade highs. The euro , which made a one-month high at $1.0865 overnight, traded at $1.0816 as investors awaited the decision.

That cast Asia's biggest economies in stark relief, with China cutting another key policy rate on Thursday amid fresh signs its economy is stumbling and traders betting the Bank of Japan will stick with its ultra-easy monetary policy this week. The yen fell about 0.9% to a six-month low of 141.43 per dollar. The yuan hit a six-month trough of 7.1819, while hopes of more stimulus sent stock indexes in Hong Kong

Belgique Dernières Nouvelles, Belgique Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

Nigerian banking stocks rise 8% after central bank governor suspendedNigeria's banking stock index rose more than 8% on Tuesday as local investors reacted to the suspension late last week of central bank governor Godwin Emefiele, who oversaw restrictive policies that cramped their earnings.

Nigerian banking stocks rise 8% after central bank governor suspendedNigeria's banking stock index rose more than 8% on Tuesday as local investors reacted to the suspension late last week of central bank governor Godwin Emefiele, who oversaw restrictive policies that cramped their earnings.

La source: ReutersAfrica - 🏆 31. / 53 Lire la suite »

Oil prices dip after unexpected rise in US crude stocksOil prices inched higher on Wednesday after industry data showed an unexpected rise in U.S. crude stocks, signalling weak demand to markets already worried about recession and disappointing Chinese economic data.

Oil prices dip after unexpected rise in US crude stocksOil prices inched higher on Wednesday after industry data showed an unexpected rise in U.S. crude stocks, signalling weak demand to markets already worried about recession and disappointing Chinese economic data.

La source: ReutersAfrica - 🏆 31. / 53 Lire la suite »

Nigerian Stocks Hit 15-Year High On Suspension of Central Bank GovernorNigerian Stocks Hit 15-Year High On Suspension of Central Bank Governor PremiumTimesng: Nigeria

Nigerian Stocks Hit 15-Year High On Suspension of Central Bank GovernorNigerian Stocks Hit 15-Year High On Suspension of Central Bank Governor PremiumTimesng: Nigeria

La source: allafrica - 🏆 1. / 99 Lire la suite »

SANBS appeals for more blood donations as stocks plummetSANBS appeals for more blood donations as stocks plummet: The South African National Blood Service (SANBS) needs to collect 3,500 units of blood a day and Khensani Mahlangu, communications specialist at the service says that there’s an urgency in…

La source: SABreakingNews - 🏆 41. / 51 Lire la suite »

Stocks rise, dollar pares losses after Fed signals more hikes aheadMSCI's global equity index closed slightly higher on Wednesday after a volatile afternoon while the dollar cut its losses after the U.S. Federal Reserve paused interest rate hikes as was widely expected but signalled that it could raise rates by another half percentage point by year-end.

Stocks rise, dollar pares losses after Fed signals more hikes aheadMSCI's global equity index closed slightly higher on Wednesday after a volatile afternoon while the dollar cut its losses after the U.S. Federal Reserve paused interest rate hikes as was widely expected but signalled that it could raise rates by another half percentage point by year-end.

La source: ReutersAfrica - 🏆 31. / 53 Lire la suite »

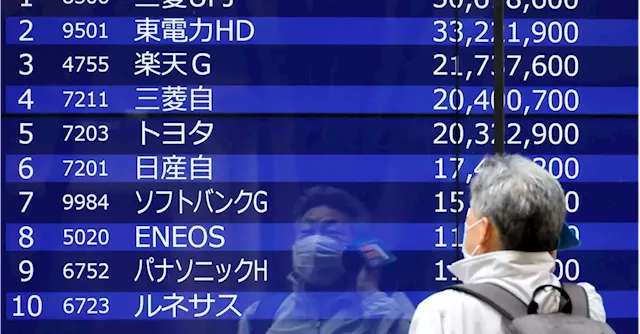

Stocks stall as US rates seen higher for longerAsian stocks braked around two-month highs on Thursday, while the dollar nursed modest losses, after the U.S. Federal Reserve chose not to hike interest rates for the first time in 17 months, even if it opened the door to more hikes ahead.

Stocks stall as US rates seen higher for longerAsian stocks braked around two-month highs on Thursday, while the dollar nursed modest losses, after the U.S. Federal Reserve chose not to hike interest rates for the first time in 17 months, even if it opened the door to more hikes ahead.

La source: ReutersAfrica - 🏆 31. / 53 Lire la suite »