Artificial intelligence can help you beat the stock market, but not in the way most investors think it will.

Consider the period since late last year — Nov. 30, 2022 to be exact — when Chat GPT debuted and AI quickly became the latest Wall Street fad. Through the end of July, Nvidia NVDA, -0.10% —whose computer chips are integral to many AI applications — gained 176%, compared to just 4.8% over the same eight-month period for the Eurekahedge AI Hedge Fund Index.

It’s also unfair to focus on just the period since Chat GPT’s launch, since eight months hardly constitutes a significant track record. But the average AI-informed hedge fund hasn’t made more money than the broad U.S. market over the longer term either, as you can see from the accompanying chart. If you have any doubt, read the seminal article from more than 30 years ago by Nobel laureate William Sharpe, entitled “The Arithmetic of Active Management.” He argued that “after costs, the return on the average actively managed dollar will be less than the return” of the overall market, and that this conclusion depends “only on the laws of addition, subtraction, multiplication and division. Nothing else is required.

Belgique Dernières Nouvelles, Belgique Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

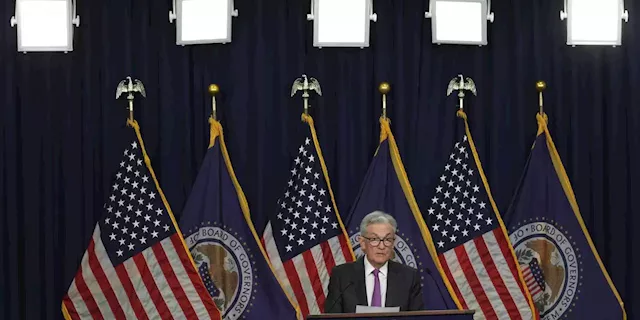

Why Treasury yields keep rising, causing pain for stock-market investorsA slow-motion breakout on long-dated Treasury yields is undermining investor confidence.

Why Treasury yields keep rising, causing pain for stock-market investorsA slow-motion breakout on long-dated Treasury yields is undermining investor confidence.

Lire la suite »

Why U.S. stock-market investors need to keep an eye on a weak Japanese yenA weak Japanese yen is nearing levels that might prompt Bank of Japan intervention --- an event that could send shock waves through global financial markets,...

Why U.S. stock-market investors need to keep an eye on a weak Japanese yenA weak Japanese yen is nearing levels that might prompt Bank of Japan intervention --- an event that could send shock waves through global financial markets,...

Lire la suite »