Some strategists see yields falling. Wouter Sturkenboom, chief investment strategist for Europe, the Middle East and Africa as well as Asia Pacific at Northern Trust Asset Management, expects the yield on the 10-year note to trade around four per cent by the end of the year.

Survey respondents also predict the yield on the 10-year Treasury inflation-protected securities will be lower five years from now, indicating that real interest rates, defined as nominal rates minus inflation, will come down. The sticking power of the U.S. stock rally in 2023 has taken several market participants by surprise, but bulls point to solid economic growth in the face of high interest rates as a sign of confidence. Outperforming tech names, bolstered by the frenzy for anything related to artificial intelligence, have helped sustain those gains.

“We should be concerned about loss-making parts of the tech sector, but I expect that the profitable tech companies, which are large and very significant earnings contributors to indexes, should be somewhat immune to higher yields,” said Rajeev De Mello, a global macro portfolio manager at Gama Asset Management SA.Article content

Belgique Dernières Nouvelles, Belgique Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

Stock Market Rally Is Set to Weather Higher Bond Yields, Investors SayThis year’s US stock market rally is strong enough to withstand another leg higher for bond yields, according to the latest Markets Live Pulse survey.

Stock Market Rally Is Set to Weather Higher Bond Yields, Investors SayThis year’s US stock market rally is strong enough to withstand another leg higher for bond yields, according to the latest Markets Live Pulse survey.

La source: BNNBloomberg - 🏆 83. / 50 Lire la suite »

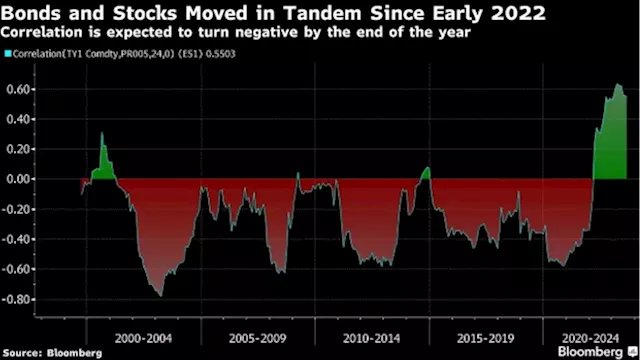

Stock Market Rally Is Set to Weather Higher Bond Yields, Investors Say(Bloomberg) -- This year’s US stock market rally is strong enough to withstand another leg higher for bond yields, according to the latest Markets Live Pulse survey.Most Read from BloombergMercedes Bets on Range Boost in Swipe at Tesla’s EV LeadDiamond Prices Are in Free Fall in One Key Corner of the MarketZelenskiy Swaps Out Defense Minister in Wartime Cabinet ShakeupHuawei Teardown Shows Chip Breakthrough in Blow to US SanctionsWith the soft-landing narrative for the world’s biggest economy ga

Stock Market Rally Is Set to Weather Higher Bond Yields, Investors Say(Bloomberg) -- This year’s US stock market rally is strong enough to withstand another leg higher for bond yields, according to the latest Markets Live Pulse survey.Most Read from BloombergMercedes Bets on Range Boost in Swipe at Tesla’s EV LeadDiamond Prices Are in Free Fall in One Key Corner of the MarketZelenskiy Swaps Out Defense Minister in Wartime Cabinet ShakeupHuawei Teardown Shows Chip Breakthrough in Blow to US SanctionsWith the soft-landing narrative for the world’s biggest economy ga

La source: YahooFinanceCA - 🏆 47. / 63 Lire la suite »