India is among the first in the world to regulate ESG rating providers and the country’s minimum requirement for funds to invest — according to their stated strategy — is “a high bar,” said Hannah Lee, JPMorgan’s head of ESG equity research for the Asia-Pacific region. “Where India stands out in terms of being trailblazing is probably its level of ambition and some of the thresholds that it has,” she said in an interview.

According to the new rules, at least 80% of total fund assets must be invested in equity and equity-related instruments that align with the stated strategy. It makes India’s the highest benchmark in Asia, Lee said. In Singapore and the Philippines, the threshold is about 67%. Lee doesn’t see that as a problem for India. “Regulation of ESG funds has helped develop ESG investing in many markets,” she said, and noted that in Europe, “flows to Article 9 products remained positive all through 2022.”

Belgique Dernières Nouvelles, Belgique Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

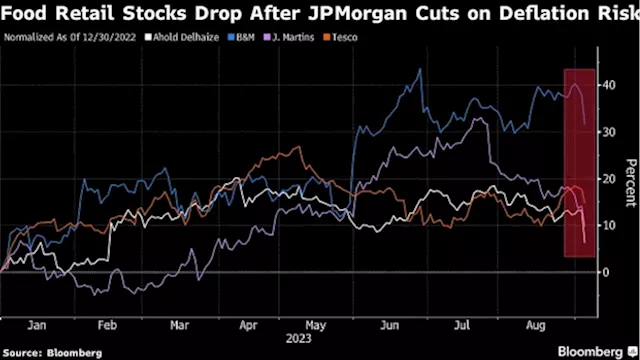

JPMorgan Analyst Sounds Deflation Warning for Grocery StocksThe potential for lower food prices in Europe is reason to be cautious on the grocery sector, according to JPMorgan Chase & Co. analyst Borja Olcese.

JPMorgan Analyst Sounds Deflation Warning for Grocery StocksThe potential for lower food prices in Europe is reason to be cautious on the grocery sector, according to JPMorgan Chase & Co. analyst Borja Olcese.

La source: BNNBloomberg - 🏆 83. / 50 Lire la suite »

The risk of a crisis over the next 6 to 12 months is rising as high rates bite and the stock market's AI rally fades, JPMorgan's quant chief saysWhile Kolanovic has been bearish on the stock market all year, he highlighted two things that need to happen for him to turn more bullish.

The risk of a crisis over the next 6 to 12 months is rising as high rates bite and the stock market's AI rally fades, JPMorgan's quant chief saysWhile Kolanovic has been bearish on the stock market all year, he highlighted two things that need to happen for him to turn more bullish.

La source: YahooFinanceCA - 🏆 47. / 63 Lire la suite »