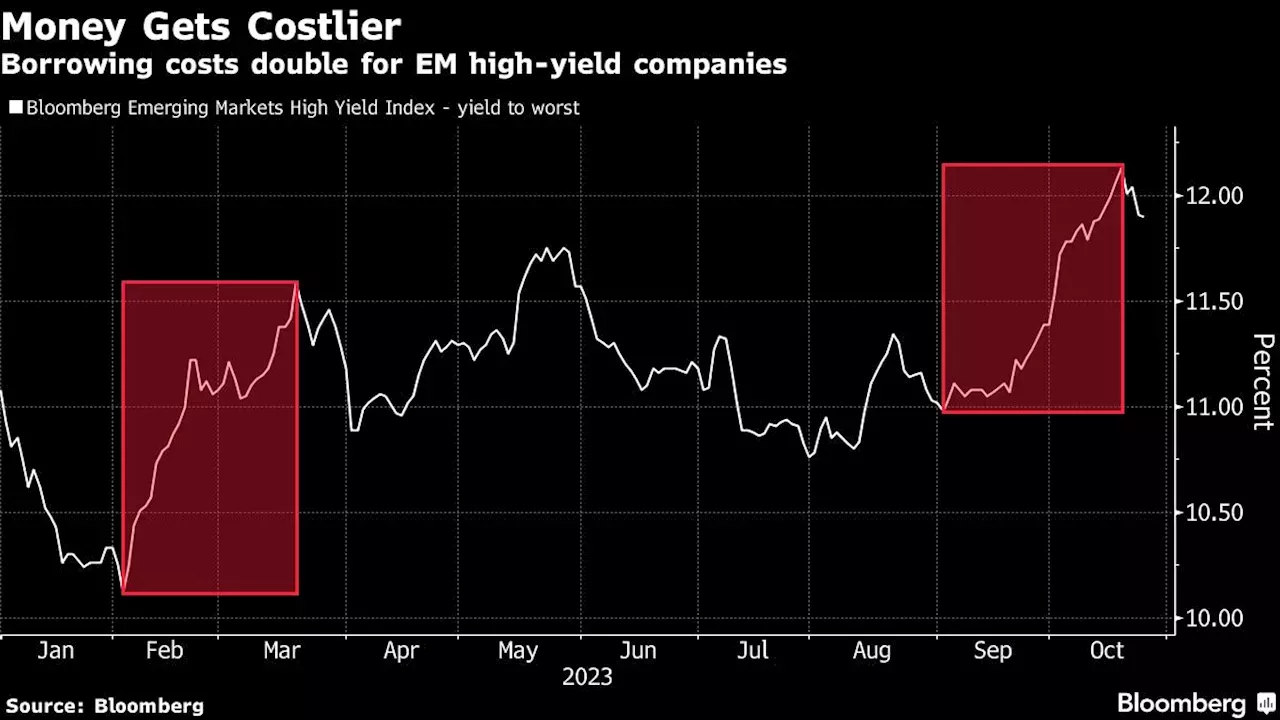

-- Cracks are deepening for vulnerable emerging-market companies as global borrowing rates surge to the highest levels since the financial crisis, halting refinancing opportunities for $400 billion worth of a debt maturities coming due in the new year.As US Treasury yields soar to 15-year highs and borrowing costs skyrocket, companies from developing nations have managed to only rollover a tenth of what they need.

We’re already seeing this play out in situations from Colombia to Dubai, where some companies had no option but to cover their upcoming maturities at nearly double-digit interest rates. For instance, Colombia’s Ecopetrol SA had to pay 8.625% and 9% to borrow $1.5 billion in June, a 4 percentage-point increase in its borrowing costs in two years. Dubai-based Shelf Drilling Holdings Ltd. sold $1.1 billion of bonds last month at 10.

“I am very selective now,” said Peter Varga, a senior professional portfolio manager at Erste Asset Management GmbH. “Weak names which survived with low refinancing costs will drop out. But I am happy to buy the names where I think the management is strong and can manage eventual slippage in fundamentals.”

“We still have a few borrowers who are closely monitoring market conditions to find a favorable window for issuance, but pipelines tend to become much more opportunistic from November,” said Stefan Weiler, the head of debt capital markets for central and eastern Europe, the Middle East and Africa at JPMorgan Chase & Co.

Belgique Dernières Nouvelles, Belgique Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

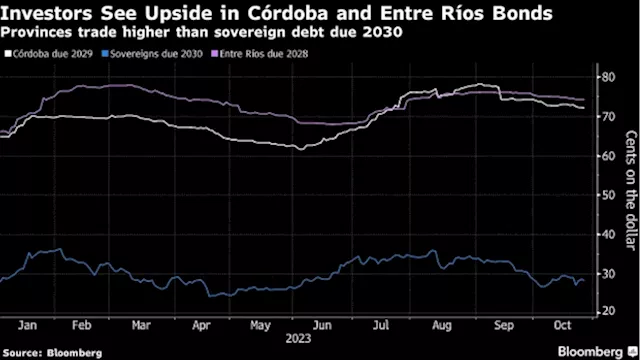

World-Beating Emerging-Market Fund Buys Argentina Province Bonds Before ElectionOne of the world’s best-performing emerging-market bond funds has piled into Argentina’s beleaguered debt market ahead of the nation’s high-stakes presidential runoff.

World-Beating Emerging-Market Fund Buys Argentina Province Bonds Before ElectionOne of the world’s best-performing emerging-market bond funds has piled into Argentina’s beleaguered debt market ahead of the nation’s high-stakes presidential runoff.

Lire la suite »

ADL calls on companies to do more to fight antisemitismThe Israel-Hamas war is sparking fresh concerns about a rise in antisemitism. Anti-Defamation League Senior Vice President and Chief Impact Officer Adam...

ADL calls on companies to do more to fight antisemitismThe Israel-Hamas war is sparking fresh concerns about a rise in antisemitism. Anti-Defamation League Senior Vice President and Chief Impact Officer Adam...

Lire la suite »

Most actively traded companies on the Toronto Stock ExchangeTORONTO — Some of the most active companies traded Friday on the Toronto Stock Exchange: Toronto Stock Exchange (18,737.39, down 137.92 points): Corus...

Most actively traded companies on the Toronto Stock ExchangeTORONTO — Some of the most active companies traded Friday on the Toronto Stock Exchange: Toronto Stock Exchange (18,737.39, down 137.92 points): Corus...

Lire la suite »

Most actively traded companies on the Toronto Stock ExchangeTORONTO — Some of the most active companies traded Friday on the Toronto Stock Exchange: Toronto Stock Exchange (18,737.39, down 137.92 points): Corus Entertainment Inc. (TSX:CJR.B). Media. Down 23 cents, or 25.28 per cent, to 68 cents on 7.

Most actively traded companies on the Toronto Stock ExchangeTORONTO — Some of the most active companies traded Friday on the Toronto Stock Exchange: Toronto Stock Exchange (18,737.39, down 137.92 points): Corus Entertainment Inc. (TSX:CJR.B). Media. Down 23 cents, or 25.28 per cent, to 68 cents on 7.

Lire la suite »

Is the Chinese government trying to acquire land and companies to spy on Canada?Canada has blocked attempts by the Chinese government to acquire properties near sensitive and strategic locations over espionage concerns, according to CSIS director David Vigneault.

Is the Chinese government trying to acquire land and companies to spy on Canada?Canada has blocked attempts by the Chinese government to acquire properties near sensitive and strategic locations over espionage concerns, according to CSIS director David Vigneault.

Lire la suite »

Credit card companies are having 'a strong year': AnalystConsumer spending remains resilient, as evidenced by the latest earnings reports from major credit card companies Visa (V), Mastercard (MA), and American...

Credit card companies are having 'a strong year': AnalystConsumer spending remains resilient, as evidenced by the latest earnings reports from major credit card companies Visa (V), Mastercard (MA), and American...

Lire la suite »