NEW YORK, Nov 8 - Some of the world's top investment bankers said on Wednesday that a drop in corporate dealmaking in 2023 sets the stage for a pick-up in activity once uncertainty around the global economy, geopolitical conflicts and regulatory hurdles subsides.

"CEOs and corporate boards do not need to have a very clear picture of what the future will look like, but they need a degree of stability," Goldman Sachs Group Inc global M&A co-head Stephan Feldgoise said at a Reuters NEXT conference panel."I'm reasonably bullish that this will return, but obviously it will be in fits and starts."

"You can see why some companies are saying, if I don't have to do this deal now, maybe it is more prudent to wait," Bank of America chairman of global M&A Steven Baronoff told the panel. JPMorgan Chase & Co global M&A head Anu Aiyengar pointed out these two deals were all-stock and said more companies are using their shares as currency to overcome acquisition targets' concerns about locking in a cheap valuation, which they would risk if they sold for cash.

Belgique Dernières Nouvelles, Belgique Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

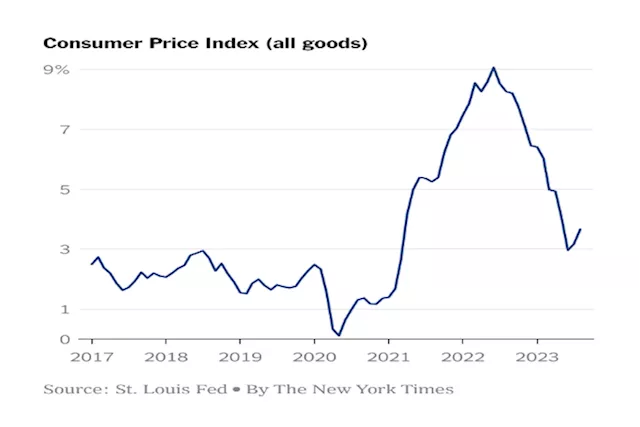

Latest market-sensitive news and views(Kitco News) - Federal Reserve Bank of Minneapolis President Neel Kashkari said it is too soon to declare victory over inflation, despite signs in recent economic releases that price pressures are easing.

Latest market-sensitive news and views(Kitco News) - Federal Reserve Bank of Minneapolis President Neel Kashkari said it is too soon to declare victory over inflation, despite signs in recent economic releases that price pressures are easing.

La source: KitcoNewsNOW - 🏆 13. / 78 Lire la suite »

Stock market news today: Stocks extend win streak as investors cling to Fed rate excitementInvestors are weighing whether the Fed is really done hiking as policymakers speak out.

Stock market news today: Stocks extend win streak as investors cling to Fed rate excitementInvestors are weighing whether the Fed is really done hiking as policymakers speak out.

La source: YahooFinanceCA - 🏆 47. / 63 Lire la suite »

European shares rise on strong earnings, pharma boostMarket News

European shares rise on strong earnings, pharma boostMarket News

La source: KitcoNewsNOW - 🏆 13. / 78 Lire la suite »