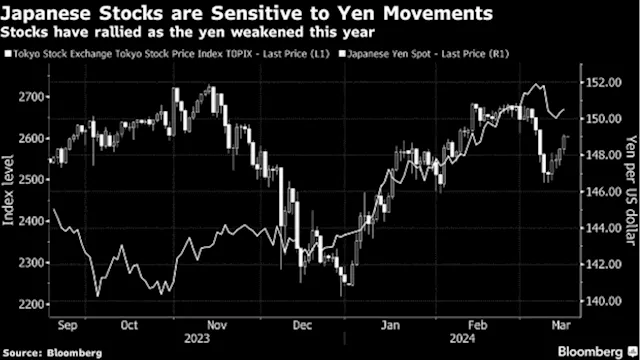

-- An out-sized selloff in Asian shares on Tuesday is underscoring concerns about the region’s fragility in the face of elevated interest rates and rising geopolitical tensions.S&P 500 Breaks Below 5,100 as Big Tech Sells Off: Markets WrapThe MSCI Asia Pacific Index dropped as much as 2.2%, the most since August last year. The slide means it is now less than 1% away from erasing its 2024 gains. The S&P 500 lost 1.2% on Monday but is still up 6.1% for the year.

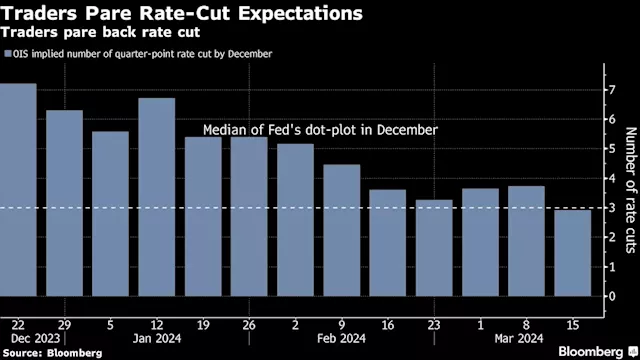

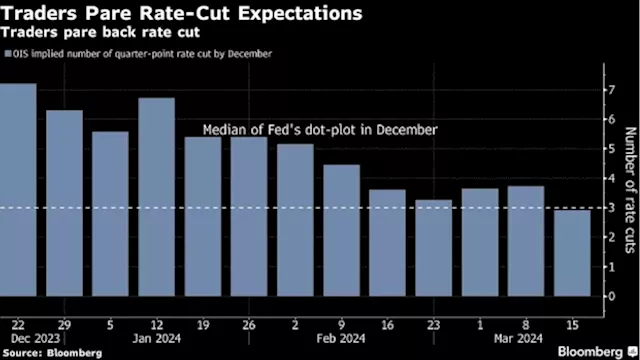

While the Asian index is estimated to deliver year-on-year profit growth of 4.1% in the January to March period, the first expansion in eight quarters, the outlook for the rest of 2024 is now in doubt in the face of a Federal Reserve that appears no longer in a rush to cut rates.A delay by the Fed is seen causing central banks in China, South Korea, Indonesia, the Philippines and Taiwan to postpone rate cuts, Morgan Stanley economists led by Chetan Ahya wrote in a note.

NEW YORK — The stock price for Donald Trump's social media company slid again Monday, pushing it more than 66% below its peak set late last month. Trump Media & Technology Group closed down 18.4% at $26.61 as more of the euphoria that surrounded the stock fades. It's a sharp comedown since nearing $80 after the owner of Truth Socialmerged with a shell company to get its stock trading on the Nasdaq under the symbol “DJT,” for Trump's initials.

The energy sector is ripe for fresh gains due to attractive valuations, investor positioning, and structural tailwinds, David Rosenberg said. -- Investors and metals traders can’t agree on what exactly is behind gold’s recent rally. At King Gold & Pawn in Brooklyn, the customers don’t care. They just want to sell.

Belgique Dernières Nouvelles, Belgique Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

Stocks Look More Vulnerable in Asia Than Peers on Fed Re-PricingAn out-sized selloff in Asian shares on Tuesday is underscoring concerns about the region’s fragility in the face of elevated interest rates and rising geopolitical tensions.

Stocks Look More Vulnerable in Asia Than Peers on Fed Re-PricingAn out-sized selloff in Asian shares on Tuesday is underscoring concerns about the region’s fragility in the face of elevated interest rates and rising geopolitical tensions.

Lire la suite »

Reddit IPO: A look at how other social media stocks traded post-IPOReddit (RDDT) is set to list on the New York Stock Exchange via an IPO on Thursday. Though the most recent, Reddit's IPO isn't the first social media...

Reddit IPO: A look at how other social media stocks traded post-IPOReddit (RDDT) is set to list on the New York Stock Exchange via an IPO on Thursday. Though the most recent, Reddit's IPO isn't the first social media...

Lire la suite »

Asia Stocks Look Mixed Ahead of BOJ Rate Decision: Markets Wrap(Bloomberg) -- Asia stocks were poised for a fairly muted open Tuesday as traders prepared for a potentially historic rate decision in Japan that’s expected ...

Asia Stocks Look Mixed Ahead of BOJ Rate Decision: Markets Wrap(Bloomberg) -- Asia stocks were poised for a fairly muted open Tuesday as traders prepared for a potentially historic rate decision in Japan that’s expected ...

Lire la suite »

Asia Stocks Look Mixed Ahead of BOJ Rate Decision: Markets WrapAsia stocks were poised for a fairly muted open Tuesday as traders prepared for a potentially historic rate decision in Japan that’s expected to end the world’s last negative rates regime.

Asia Stocks Look Mixed Ahead of BOJ Rate Decision: Markets WrapAsia stocks were poised for a fairly muted open Tuesday as traders prepared for a potentially historic rate decision in Japan that’s expected to end the world’s last negative rates regime.

Lire la suite »

Asia Stocks Look Muted Ahead of Central Bank Week: Markets WrapAsia stocks are expected to have a muted performance ahead of the central bank week. Adani dollar bonds have fallen the most in over six months due to a US probe. Goldman Sachs now predicts that the Bank of Japan will scrap negative interest rates on Tuesday. South Africa has started the process of allowing private rail network use. TSMC bulls are ignoring Warren Buffett's warning and betting on the coming AI age. Oil prices are holding steady after more Russian refineries were attacked. The Federal Reserve and the Bank of Japan dominate the rate week for almost half of the global economy. China has started the year with record oil processing due to holiday demand. A New York ruling on Chinese developer bonds clarifies creditor standing. The gender pay gap still exists in 2024, despite equal education. Experts provide tips for reporting income from side hustles and avoiding the pink tax on everyday items. It is time to shift parked RRSP contributions into drive. Are you getting paid for an extra day of work on February 29th?

Asia Stocks Look Muted Ahead of Central Bank Week: Markets WrapAsia stocks are expected to have a muted performance ahead of the central bank week. Adani dollar bonds have fallen the most in over six months due to a US probe. Goldman Sachs now predicts that the Bank of Japan will scrap negative interest rates on Tuesday. South Africa has started the process of allowing private rail network use. TSMC bulls are ignoring Warren Buffett's warning and betting on the coming AI age. Oil prices are holding steady after more Russian refineries were attacked. The Federal Reserve and the Bank of Japan dominate the rate week for almost half of the global economy. China has started the year with record oil processing due to holiday demand. A New York ruling on Chinese developer bonds clarifies creditor standing. The gender pay gap still exists in 2024, despite equal education. Experts provide tips for reporting income from side hustles and avoiding the pink tax on everyday items. It is time to shift parked RRSP contributions into drive. Are you getting paid for an extra day of work on February 29th?

Lire la suite »

Asia Stocks Look Muted Ahead of Central Bank Week: Markets WrapAsian stocks are poised for a mixed start into a week that includes policy decisions from the Bank of Japan and Federal Reserve that will likely set the near-term direction for global markets.

Asia Stocks Look Muted Ahead of Central Bank Week: Markets WrapAsian stocks are poised for a mixed start into a week that includes policy decisions from the Bank of Japan and Federal Reserve that will likely set the near-term direction for global markets.

Lire la suite »