Industry-specific ERP solutions: Deep dive into AI customisationThe rise of AI has revolutionised numerous industries and its impact on enterprise resource planning is undeniable. By integrating AI into industry-specific ERP solutions, businesses can address their unique challenges and unlock a new level of efficiency, productivity and decision-making. Let's examine how AI is customised for specific industries, focusing on healthcare, manufacturing and finance.

Prescriptive recommendations: AI models analyse data and suggest proactive measures to address potential problems before they occur, minimising downtime and ensuring consistent production flow.Challenge: Ensuring consistent product quality and minimising defects is crucial for manufacturers, but traditional quality control methods often involve manual inspections, which can be time-consuming and prone to error.

Self-correcting systems: AI-powered systems can adjust production parameters on the fly based on real-time data, ensuring consistent quality throughout the production process.Challenge: Unplanned equipment downtime can lead to significant losses in production and revenue. Traditional maintenance schedules often fail to predict equipment failures accurately, resulting in unnecessary downtime and increased costs.

Self-healing systems: AI-powered systems can automatically adjust equipment settings or trigger maintenance procedures based on real-time data, further minimising downtime and ensuring optimal equipment performance.Challenge: Financial institutions constantly face the threat of fraud and cyber attacks, resulting in significant financial losses. Traditional fraud detection methods often rely on manual analysis, which can be slow and ineffective.

Biometric authentication: AI-powered facial recognition and voice recognition systems can be used to verify customer identities and prevent unauthorised access to accounts.Challenge: Making informed financial decisions requires a deep understanding of market trends, economic indicators and potential risks. Traditional risk management methods often rely on historical data and may fail to capture dynamic market fluctuations.

Algorithmic trading: AI-powered trading algorithms can investigate market data and execute trades in real-time, optimising returns and minimising risks.Challenge: Providing personalised customer service and meeting the diverse needs of customers in the financial sector can be challenging. Traditional CRM systems often lack the ability to analyse customer data effectively and deliver personalised recommendations.

Belgique Dernières Nouvelles, Belgique Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

Gugulethu Xofa Speaks on Influencers in the Acting Industry: “A Lot Has Changed in the Industry”Gugulethu Xofa addressed the influx of influencers in the acting industry. She said social media celebs receive preferential treatment over professional actors

Gugulethu Xofa Speaks on Influencers in the Acting Industry: “A Lot Has Changed in the Industry”Gugulethu Xofa addressed the influx of influencers in the acting industry. She said social media celebs receive preferential treatment over professional actors

Lire la suite »

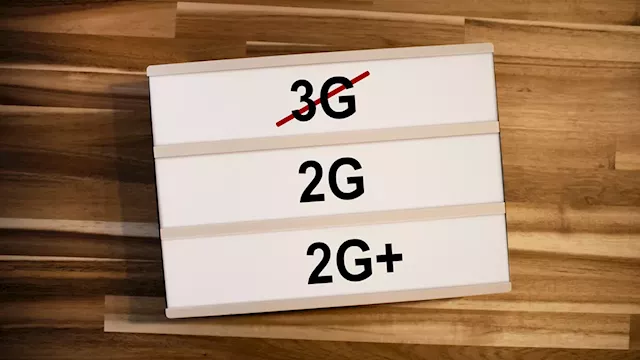

Telco industry body calls for industry-driven 2G, 3G sunsettingThe Association of Comms and Technology advocates for less stringent government deadlines, as the state eyes December 2027 as shutdown for 2G and 3G.

Telco industry body calls for industry-driven 2G, 3G sunsettingThe Association of Comms and Technology advocates for less stringent government deadlines, as the state eyes December 2027 as shutdown for 2G and 3G.

Lire la suite »