Investing.com-- BoFA trimmed its year-end forecasts for Japan’s benchmark stock indexes, but said that markets could begin recovering in the coming month on improving corporate guidance and as inflation perks up.The brokerage said that while Japanese firms had performed well in the June quarter earnings season, most firms had still presented a conservative outlook on future earnings, which raised the chances of guidance hikes in the coming quarters.

While both indexes did rebound sharply from last week’s losses, they still remained within a bear market. They noted that while yen appreciation did present some risks to future earnings, it would still have a limited overall impact.seemed to price in a sudden deterioration in earnings -- was mostly due to anticipating aBut they envisioned a mostly soft landing for the U.S. economy, which could present more upside for stocks.

Belgique Dernières Nouvelles, Belgique Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

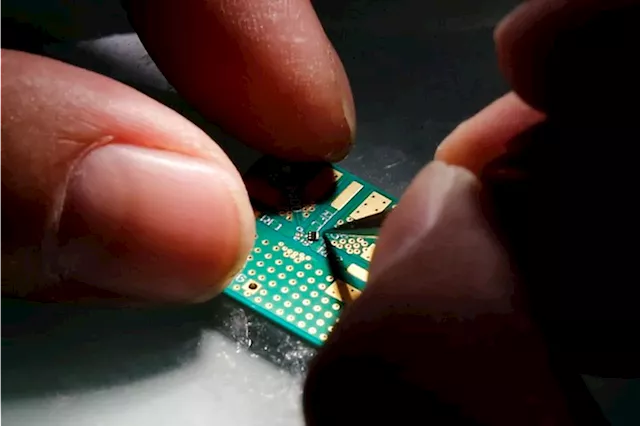

3 chip stocks to buy to play a rebound in SOX: BofA3 chip stocks to buy to play a rebound in SOX: BofA

3 chip stocks to buy to play a rebound in SOX: BofA3 chip stocks to buy to play a rebound in SOX: BofA

Lire la suite »

BofA's institutional clients net buyers of US stocks for first time in 5 weeksBofA's institutional clients net buyers of US stocks for first time in 5 weeks

BofA's institutional clients net buyers of US stocks for first time in 5 weeksBofA's institutional clients net buyers of US stocks for first time in 5 weeks

Lire la suite »

Investors reduced allocations to stocks, moved to cash in August, BofA survey showsInvestors reduced allocations to stocks, moved to cash in August, BofA survey shows

Investors reduced allocations to stocks, moved to cash in August, BofA survey showsInvestors reduced allocations to stocks, moved to cash in August, BofA survey shows

Lire la suite »

BofA's clients are buying the dip in stocksBofA's clients are buying the dip in stocks

BofA's clients are buying the dip in stocksBofA's clients are buying the dip in stocks

Lire la suite »