U.S. stocks were back on the downswing in a big way Wednesday, underlining warnings from some market veterans that sharp rebounds in what has so far been a down year for equities may be little more than the sort of volatile, short-lived upside rebounds characteristic of bear markets.

Equities last week tumbled sharply last week with the S&P 500 coming within a whisker of entering bear market territory —- a drop of 20% from a recent peak —- before bouncing on Friday. A close below 3,837. 25 would mark a 20% drop from the large-cap benchmark’s Jan. 3 record finish.While the S&P 500 has yet to technically enter bear territory, analysts have noted the selloff has demonstrated bear-market characteristics.

The 10‐day figure, meanwhile, has become overbought, deGraaf said, but noted that tends to be “a bullish thrust signal” three months forward, and better than the three-week forward signal .

Brasil Últimas Notícias, Brasil Manchetes

Similar News:Você também pode ler notícias semelhantes a esta que coletamos de outras fontes de notícias.

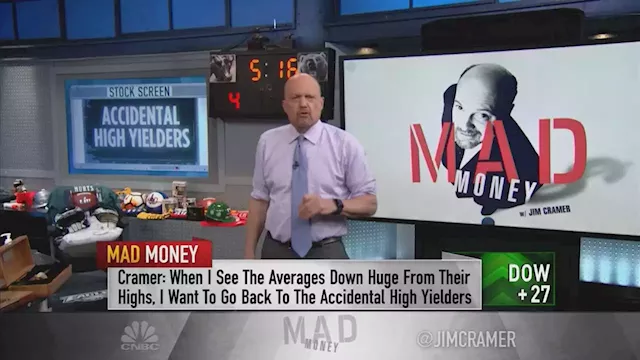

Watch Jim Cramer break down which high-yielding stocks are investable and whyThe 'Mad Money' host on Monday's episode of the show explained why investors should be looking at high-yielding stocks — while still being selective — to navigate the current market.

Watch Jim Cramer break down which high-yielding stocks are investable and whyThe 'Mad Money' host on Monday's episode of the show explained why investors should be looking at high-yielding stocks — while still being selective — to navigate the current market.

Consulte Mais informação »

Why this investor who paid $650,000 to lunch with Buffett isn't buying or selling stocks right nowYou’re not going to find many like Guy Spier’s Aquamarine Capital in the first quarter — zero buys, zero sells. Spier’s investments in Berkshire Hathaway account for about a third of his roughly $350 million portfolio.

Why this investor who paid $650,000 to lunch with Buffett isn't buying or selling stocks right nowYou’re not going to find many like Guy Spier’s Aquamarine Capital in the first quarter — zero buys, zero sells. Spier’s investments in Berkshire Hathaway account for about a third of his roughly $350 million portfolio.

Consulte Mais informação »