The shares of companies that have gone public through blank-check mergers have performed dismally.The latest Bay Area company to agree to such a combination is Movella Inc., which announced Tuesday plans to merge with Pathfinder Acquisition Corp. . Movella expects to get as much as $336 million from the deal and to have a valuation of between $530 million and $755 million after it's completed, which they expect to happen in the first quarter.

Palo Alto-based Pathfinder raised $325 million in its initial public offering early last year, when investors were still enthusiastic about special purpose acquisition companies like it. But Movella andPathfinder forecast that the startup would get just $121 million out of their merger if 90% of the latter's shares are exchanged for cash.San Jose-based Movella posted just $33 million in revenue last year, according to ait and Pathfinder put together for the latter's investors.

Meanwhile, the startup, which offers movement tracking sensors and software for customers in the entertainment, health, sports, automation and mobility industries, is operating in the red at a time when Wall Street investors have been increasingly focusing on companies' bottom lines. Movella didn't disclose its actual bottom line, but said that excluding certain costs, it would have posted a $9.1 million loss last year. On that same basis, the company, whose customers include Electronic Arts Inc., NBCUniversal Media LLC, Daimler and Siemens AG, expects to lose $9 million this year and to be break even next year.San Jose, $75 million: Owl Rock Capital led the Series C round for this provider of multi-cloud data protection, governance and security software.

Brasil Últimas Notícias, Brasil Manchetes

Similar News:Você também pode ler notícias semelhantes a esta que coletamos de outras fontes de notícias.

Xperi stock plunged after it completed spinoff of patent business as Adeia - Silicon Valley Business JournalThe San Jose-based company now known as Xperi Inc. retained the product side of its business, which includes digital video recorder TiVo and audio tech seller DTS. It spun off its patent licensing side as Adeia Inc.

Xperi stock plunged after it completed spinoff of patent business as Adeia - Silicon Valley Business JournalThe San Jose-based company now known as Xperi Inc. retained the product side of its business, which includes digital video recorder TiVo and audio tech seller DTS. It spun off its patent licensing side as Adeia Inc.

Consulte Mais informação »

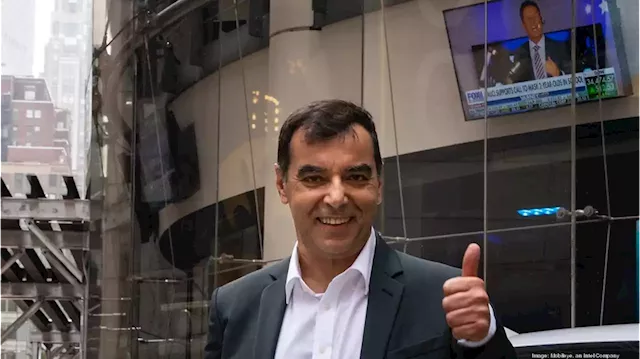

Intel files for Mobileye IPO that may raise up to $2.5 billion - Silicon Valley Business JournalIt's estimated that the offering may raise up to $2.5 billion, which would top the $1 billion IPO by investment firm TPG Inc. in January and the $1.7 billion one by life and asset management business Corebridge Financial Inc. last month.

Intel files for Mobileye IPO that may raise up to $2.5 billion - Silicon Valley Business JournalIt's estimated that the offering may raise up to $2.5 billion, which would top the $1 billion IPO by investment firm TPG Inc. in January and the $1.7 billion one by life and asset management business Corebridge Financial Inc. last month.

Consulte Mais informação »

Apple suppliers moved operations closer to Cupertino amid pandemic - Silicon Valley Business JournalThe number with manufacturing in California rose to 30 in 2021 from 10 in 2020, according to a list released by Apple.

Apple suppliers moved operations closer to Cupertino amid pandemic - Silicon Valley Business JournalThe number with manufacturing in California rose to 30 in 2021 from 10 in 2020, according to a list released by Apple.

Consulte Mais informação »

Apple suppliers moved operations closer to Cupertino amid pandemic - Silicon Valley Business JournalThe number with manufacturing in California rose to 30 in 2021 from 10 in 2020, according to a list released by Apple.

Apple suppliers moved operations closer to Cupertino amid pandemic - Silicon Valley Business JournalThe number with manufacturing in California rose to 30 in 2021 from 10 in 2020, according to a list released by Apple.

Consulte Mais informação »

Stanford's Carolyn Bertozzi wins Nobel Prize in chemistry - Silicon Valley Business JournalThe new Nobel winner in chemistry received her Ph.D. at UC Berkeley, did her post-doctoral work at UCSF and made the move from Berkeley to Stanford in 2015.

Stanford's Carolyn Bertozzi wins Nobel Prize in chemistry - Silicon Valley Business JournalThe new Nobel winner in chemistry received her Ph.D. at UC Berkeley, did her post-doctoral work at UCSF and made the move from Berkeley to Stanford in 2015.

Consulte Mais informação »