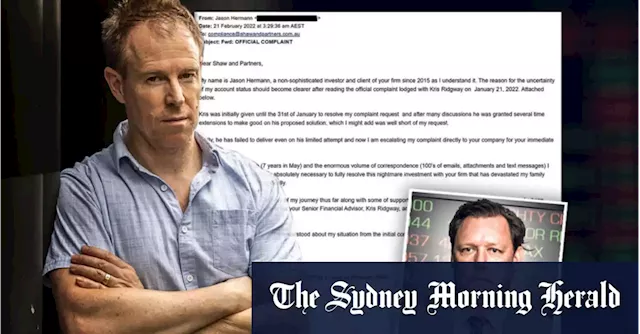

Four days after the email, Ridgway was sacked and reported to the Australian Securities and Investments Commission. He had circumvented Shaw’s compliance systems over eight years and had put up to 100 investors into unauthorised products and had taken secret commissions, which is illegal.

He contacted the company’s external auditors, Nexia, which had audited the accounts and had told him it had relied on independent valuations. “It turned out that those valuations were not independent,” Helberg says. He says that based on a PwC investigation, the valuation was prepared by a business that operated from the same address as Sutton.

Helberg believes more than 2000 investors have been caught in the scheme, which includes ASAF and other companies such as Steppes and Trinus, all linked to Sutton and Turner and all spruiked to investors by Ridgway and other financial advisers. “Aus Streaming was going to go public via a reverse merger, which, due to circumstances beyond the company’s control, it did not complete,” he says.

There have been multiple company name changes, restructurings and share transfers between entities, all of which made it difficult for investors like Hermann to understand an already complex structure.Andrew Turner at his home in England.There have also been various attempts to raise new money.

It was a brazen call given markets around the world were volatile but, with templates ready to go, brochures promised investors a stock with bullish growth. One graphic showed McFaddens assets under management at $1.8 billion, ballooning to $4.8 billion by 2024. It worked for a while, until a certain point, when Ridgway got sacked and Sutton and Turner started to withdraw. Updates became less frequent and documents that were issued had a signature of the company, not a person, which added to the opacity.

Brasil Últimas Notícias, Brasil Manchetes

Similar News:Você também pode ler notícias semelhantes a esta que coletamos de outras fontes de notícias.

The email that brought a global investment scheme undoneKris Ridgway sold unlisted shares to unsuspecting clients, hoping the companies would be listed. They weren’t. One of those clients and a former executive set in motion the events that would expose his wrongdoing.

The email that brought a global investment scheme undoneKris Ridgway sold unlisted shares to unsuspecting clients, hoping the companies would be listed. They weren’t. One of those clients and a former executive set in motion the events that would expose his wrongdoing.

Consulte Mais informação »