The Fed’s message was that monthly bond purchases may be reduced at year-end, but it will be gradual and must not be seen as indicative of any imminent hiking of interest rates. Large tech companies’ stocks surged on the development, presenting another blow to short-sellers, who hoped that a tighter monetary policy would pull back equity shares, mostly Big Tech, from their present highs.

Apple reached new heights, increasing its market cap to $2.6tr, while Microsoft, Amazon and Tesla all gained ground on the pronouncements from Fed chair Jerome Powell.Get 14 days free to read all our investigative and in-depth journalism. Thereafter you will be billed R75 per month. You can cancel anytime and if you cancel within 14 days you won't be billed.

Brasil Últimas Notícias, Brasil Manchetes

Similar News:Você também pode ler notícias semelhantes a esta que coletamos de outras fontes de notícias.

Business Maverick: US Stocks Rise Ahead of Fed; Short-Term Bonds Gain: Markets WrapUS stocks advanced and short-term Treasuries gained as investors debated whether inflation had eased enough to encourage the Federal Reserve to slow monetary tightening.

Business Maverick: US Stocks Rise Ahead of Fed; Short-Term Bonds Gain: Markets WrapUS stocks advanced and short-term Treasuries gained as investors debated whether inflation had eased enough to encourage the Federal Reserve to slow monetary tightening.

Consulte Mais informação »

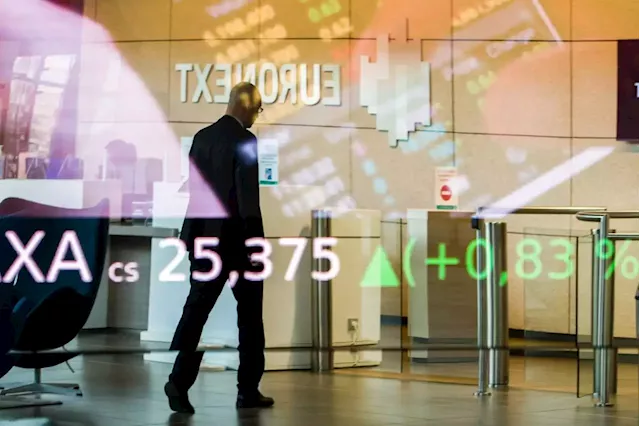

Business Maverick: Global markets: European markets slip, China eases pandemic measuresEuropean stock indexes were mostly lower on Monday, finding little support from an easing of China’s domestic pandemic restrictions, after market sentiment was dampened by US jobs data on Friday that raised fears of persistent inflation.

Business Maverick: Global markets: European markets slip, China eases pandemic measuresEuropean stock indexes were mostly lower on Monday, finding little support from an easing of China’s domestic pandemic restrictions, after market sentiment was dampened by US jobs data on Friday that raised fears of persistent inflation.

Consulte Mais informação »

Why Business Talk is South Africa’s leading online business talk showBusiness Talk with Michael Avery is South Africa’s top online business talk show and continues to grow in popularity.

Why Business Talk is South Africa’s leading online business talk showBusiness Talk with Michael Avery is South Africa’s top online business talk show and continues to grow in popularity.

Consulte Mais informação »