“Soft landings are not impossible, but they’re pretty improbable,” said Bob Elliott, co-founder, chief executive officer and chief investment officer at Unlimited Funds, in a phone interview. “They’re particularly challenging in an environment where the labor market is tight,” he said, and yet “many investors are sort of enamored with this idea that we could get a soft landing.

The consumer-price index showed U.S. inflation rose 0.2% in June for a year-over-year rate of 3%, according to a report Wednesday from the Bureau of Labor Statistics. Core CPI, which excludes energy and food prices, increased 0.2% last month for a year-over-year rate of 4.8%. The Bureau of Labor Statistics said core inflation’s rise in June marked the smallest monthly increase since August 2021.

After the expected increase in July, traders in the fed-funds-futures market were on Wednesday largely expecting the Fed to hold rates steady for the rest of the year.

Brasil Últimas Notícias, Brasil Manchetes

Similar News:Você também pode ler notícias semelhantes a esta que coletamos de outras fontes de notícias.

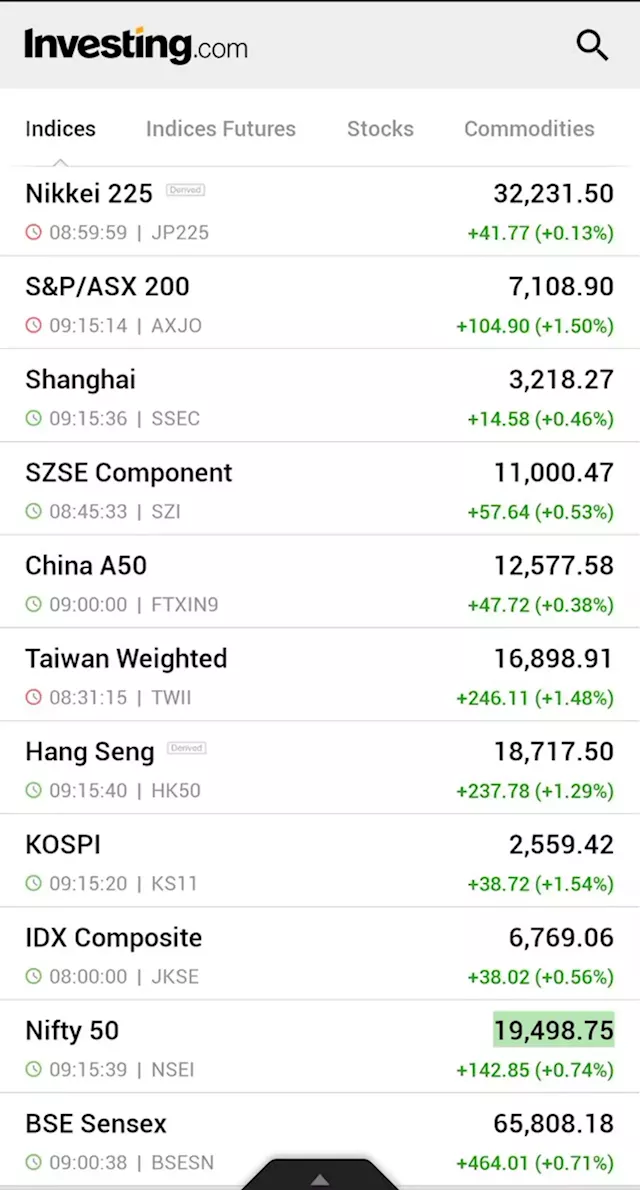

Asian stocks surge as markets bet on peak Fed rates, China stimulus By Investing.com⚠️BREAKING: *ASIAN SHARES JUMP AS INVESTORS EYE END TO FED HIKES, CHINA STIMULUS 🇯🇵🇦🇺🇨🇳🇭🇰🇰🇷🇮🇩🇮🇳

Asian stocks surge as markets bet on peak Fed rates, China stimulus By Investing.com⚠️BREAKING: *ASIAN SHARES JUMP AS INVESTORS EYE END TO FED HIKES, CHINA STIMULUS 🇯🇵🇦🇺🇨🇳🇭🇰🇰🇷🇮🇩🇮🇳

Consulte Mais informação »