Deluard noted the S&P 500 has rallied 25% from its October lows, and now trades at more than 22 times earnings. Investors might decide to cut their exposure to stocks, given the growing pressure on corporate profits, and the fact that 2-year and 10-year Treasury yields have jumped to almost 5% and 4% respectively, he said.will also thaw in time, Deluard said. Many homeowners have locked in cheap, fixed-rate mortgages and are loath to give them up by selling.

"Look at the real estate market, no one wants to sell," Deluard said."But eventually, people switch jobs, move cities, get divorced, die. That will bring the prices down." As for the wider US economy, it has defied recession forecasts and rebounded for a few reasons, Deluard said. He pointed to public-spending programs such as the Inflation Reduction Act and CHIPS and Science Act, cost-of-living adjustments to payments for social-security recipients, and inflation-related tweaks to income-tax brackets.

However, Deluard predicted the growth outlook would darken by January or February."A lot of that momentum is going to slow, it's going to hit the brakes," he said, adding that the Fed's rate hikes are ultimately"going to bite."

Brasil Últimas Notícias, Brasil Manchetes

Similar News:Você também pode ler notícias semelhantes a esta que coletamos de outras fontes de notícias.

Tupperware's and Yellow's stocks have skyrocketed, but don’t confuse them with meme stocksShares of Tupperware and Yellow have soared recently, but they shouldn’t be confused with meme stocks, says Samantha LaDuc, founder of LaDucTrading.com

Tupperware's and Yellow's stocks have skyrocketed, but don’t confuse them with meme stocksShares of Tupperware and Yellow have soared recently, but they shouldn’t be confused with meme stocks, says Samantha LaDuc, founder of LaDucTrading.com

Consulte Mais informação »

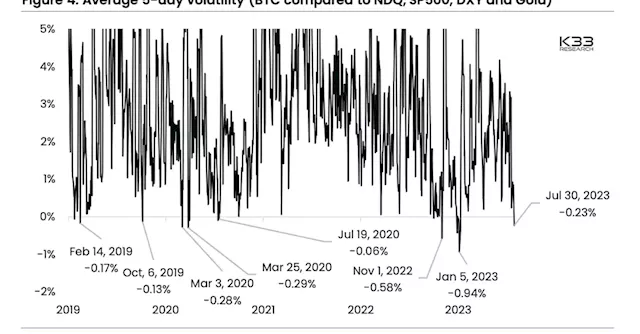

Bitcoin Has Been More Stable Than Gold and Stocks; Violent Price Action Could Ensue$BTC's recent 5-day average volatility has dropped below gold, the Nasdaq 100 and the S&P 500. Such uneventful periods in the past have led to violent breakouts with dramatic price changes, K33Research noted. sndr_krisztian reports

Bitcoin Has Been More Stable Than Gold and Stocks; Violent Price Action Could Ensue$BTC's recent 5-day average volatility has dropped below gold, the Nasdaq 100 and the S&P 500. Such uneventful periods in the past have led to violent breakouts with dramatic price changes, K33Research noted. sndr_krisztian reports

Consulte Mais informação »

Bitcoin price taps $29.3K as data shows ‘most resilient’ US jobs marketBlink and you'll miss it — BTC offers traders a glimmer of volatility on U.S. macro data.

Bitcoin price taps $29.3K as data shows ‘most resilient’ US jobs marketBlink and you'll miss it — BTC offers traders a glimmer of volatility on U.S. macro data.

Consulte Mais informação »