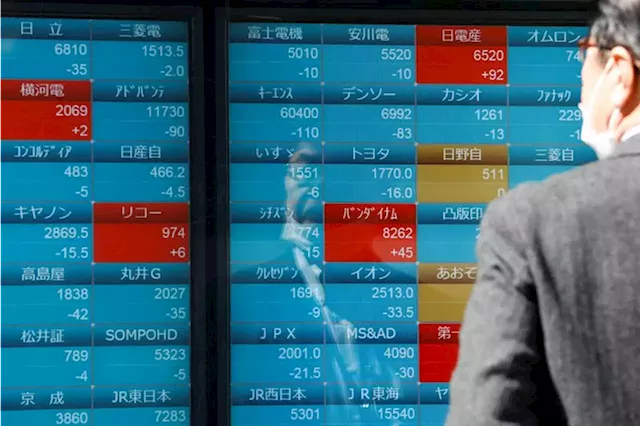

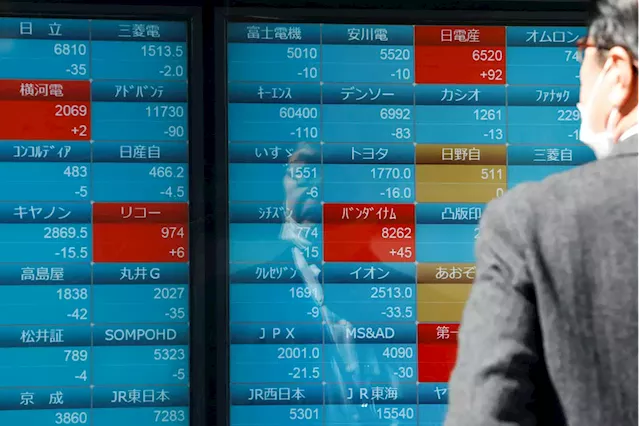

Contracts fell for equity benchmarks in Japan and Hong Kong, where the start of trading was delayed by heavy rains, while those for Australia and the US were flat in early trading. The Nasdaq 100 and S&P 500 fell as Apple slid about 6.5% in two days, while an index of US-traded Chinese stocks dropped the most in more than a month. The dollar is headed for its longest weekly rally in years amid speculation the Federal Reserve will keep interest rates elevated.

“Apple’s growth story is heavily reliant on China, and if the Beijing crackdown intensifies, that could pose a big problem to the bunch of other megacap tech companies that rely on China,” said Edward Moya, senior market analyst for the Americas at Oanda. “We expect market choppiness to persist near term,” said Keith Lerner, co-chief investment officer at Truist Advisory Services. “September, like August, has tended to be a more challenging month, and there remains a dearth of obvious near-term upside catalysts as stocks continue to digest the big year-to-date gains.”Traders also kept a close eye on the latest US economic data, with solid jobless claims figures reinforcing the case for the Fed to keep rates elevated.

Fed Bank of New York President John Williams said US monetary policy is “in a good place,” but officials will need to parse through data to decide on how to proceed on interest rates. He spoke during a moderated discussion with Bloomberg’s Michael McKee in New York.

Brasil Últimas Notícias, Brasil Manchetes

Similar News:Você também pode ler notícias semelhantes a esta que coletamos de outras fontes de notícias.

Asia Stocks to Follow Wall Street’s Apple-Led Drop: Markets WrapStocks in Asia were set to follow a big tech-led drop on Wall Street amid concern over how a Chinese ban on Apple Inc.’s iPhone could impact the industry that has driven this year’s market rally. The dollar strengthened and Treasuries rose.

Asia Stocks to Follow Wall Street’s Apple-Led Drop: Markets WrapStocks in Asia were set to follow a big tech-led drop on Wall Street amid concern over how a Chinese ban on Apple Inc.’s iPhone could impact the industry that has driven this year’s market rally. The dollar strengthened and Treasuries rose.

Consulte Mais informação »

Asia stocks fall as global growth concerns mountAsia stocks fell on Wednesday after weak economic data in China and Europe heightened concerns over global growth, while the dollar firmed as investors weighed the outlook for U.S. interest rates. The Hang Seng Index and China's benchmark CSI300 Index both opened down about 0.3%. A private-sector survey on Tuesday showed China's services activity expanded at the slowest pace in eight months in August, reflecting weak demand.

Asia stocks fall as global growth concerns mountAsia stocks fell on Wednesday after weak economic data in China and Europe heightened concerns over global growth, while the dollar firmed as investors weighed the outlook for U.S. interest rates. The Hang Seng Index and China's benchmark CSI300 Index both opened down about 0.3%. A private-sector survey on Tuesday showed China's services activity expanded at the slowest pace in eight months in August, reflecting weak demand.

Consulte Mais informação »

Asia stocks fall as global growth concerns mountBy Kane Wu HONG KONG (Reuters) - Asia stocks fell on Wednesday after weak economic data in China and Europe heightened concerns over global growth, ...

Asia stocks fall as global growth concerns mountBy Kane Wu HONG KONG (Reuters) - Asia stocks fell on Wednesday after weak economic data in China and Europe heightened concerns over global growth, ...

Consulte Mais informação »

Asia Stocks Under Pressure, Dollar Strengthens: Markets WrapAsian equity futures drifted lower as US stocks fell following economic data that exceeded forecasts, bolstering the case for the Federal Reserve to keep interest rates elevated for longer.

Asia Stocks Under Pressure, Dollar Strengthens: Markets WrapAsian equity futures drifted lower as US stocks fell following economic data that exceeded forecasts, bolstering the case for the Federal Reserve to keep interest rates elevated for longer.

Consulte Mais informação »

Asia Stocks Under Pressure, Dollar Strengthens: Markets Wrap(Bloomberg) -- Asian equity futures drifted lower as US stocks fell following economic data that exceeded forecasts, bolstering the case for the Federal Reserve to keep interest rates elevated for longer.Most Read from BloombergIndia’s Moment Has Arrived, and Modi Wants a New Global OrderStocks Retreat After Hot ISM Fuels Fed-Hike Wagers: Markets WrapFed Set to Double Its Economic Growth Forecast After Strong US DataSoaring US Dollar Raises Alarm as China, Japan Escalate FX PushbackChina Slowdow

Asia Stocks Under Pressure, Dollar Strengthens: Markets Wrap(Bloomberg) -- Asian equity futures drifted lower as US stocks fell following economic data that exceeded forecasts, bolstering the case for the Federal Reserve to keep interest rates elevated for longer.Most Read from BloombergIndia’s Moment Has Arrived, and Modi Wants a New Global OrderStocks Retreat After Hot ISM Fuels Fed-Hike Wagers: Markets WrapFed Set to Double Its Economic Growth Forecast After Strong US DataSoaring US Dollar Raises Alarm as China, Japan Escalate FX PushbackChina Slowdow

Consulte Mais informação »

Asia stocks slide on U.S. rate worries, dollar ascendantAsian stocks sank on Thursday, extending global equity declines after new signs of sustained inflationary pressures in the United States boosted the case for elevated interest rates for longer. The U.S. dollar hung close to the highest since mid-March against major peers, and touched a fresh 10-month top to the yen.

Consulte Mais informação »