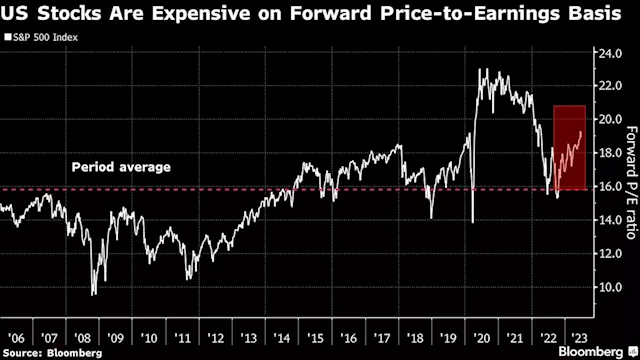

for the Federal Reserve. But that's not priced into the stock market, according to Oppenheimer's Chief Investment Strategist John Stoltzfus.

Stoltzfus made no mention of moving down his year-end target for the S&P 500 of 4,900 but notes inflation is still too far off the Fed's 2% goal. Expectations are for the latest Consumer Prices Index reading on Wednesday morning to show prices rose 3.6% over the prior year in August,On a "core" basis, which strips out the volatile food and energy categories, CPI is expected to rise 4.3% over last year in August, a slowdown from the 4.7% increase seen in July.

Brasil Últimas Notícias, Brasil Manchetes

Similar News:Você também pode ler notícias semelhantes a esta que coletamos de outras fontes de notícias.

Oppenheimer’s Stoltzfus Says US Stocks Are Likely to Dip FurtherThe recent pullback in US stocks has further to go, according to Wall Street’s most bullish strategist.

Oppenheimer’s Stoltzfus Says US Stocks Are Likely to Dip FurtherThe recent pullback in US stocks has further to go, according to Wall Street’s most bullish strategist.

Consulte Mais informação »

Oppenheimer’s Stoltzfus Says US Stocks Are Likely to Dip Further(Bloomberg) -- The recent pullback in US stocks has further to go, according to Wall Street’s most bullish strategist.Most Read from BloombergTrudeau Is Stuck in India With Faulty Aircraft After Hearing Criticism From ModiIndia’s G-20 Win Shows US Learning How to Counter China RiseMeloni Tells China That Italy Plans to Exit Belt and RoadBiden Doubts China Able to Invade Taiwan Amid Economic WoesThe Mighty American Consumer Is About to Hit a Wall, Investors Say“Bullishness is relatively high whil

Oppenheimer’s Stoltzfus Says US Stocks Are Likely to Dip Further(Bloomberg) -- The recent pullback in US stocks has further to go, according to Wall Street’s most bullish strategist.Most Read from BloombergTrudeau Is Stuck in India With Faulty Aircraft After Hearing Criticism From ModiIndia’s G-20 Win Shows US Learning How to Counter China RiseMeloni Tells China That Italy Plans to Exit Belt and RoadBiden Doubts China Able to Invade Taiwan Amid Economic WoesThe Mighty American Consumer Is About to Hit a Wall, Investors Say“Bullishness is relatively high whil

Consulte Mais informação »