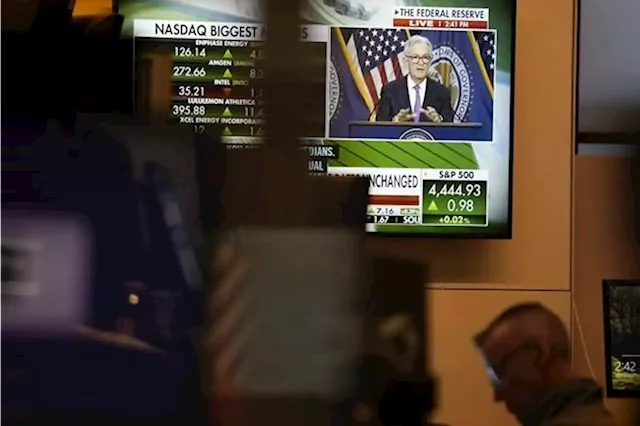

NEW YORK — Wall Street’s worst week in six months closed on another weak note. The S&P 500 gave up an early gain and ended 0.2% lower Friday. The Dow Jones Industrial Average lost 106 points, and the Nasdaq composite slipped 0.1%. Stocks slid this week because of the growing understanding that interest rates likely won’t come down much anytime soon. Treasury yields eased a bit after jumping earlier in the week to their highest levels in more than a decade.

Yields were easing a bit Friday, which reduced the pressure on the stock market. The yield on the 10-year Treasury slipped to 4.44% from 4.50% late Thursday. It’s still near its highest level since 2007. Recently, that’s meant pain for technology stocks. Nvidia trimmed its loss for the week to 4.7% after rising 2% Friday. The Nasdaq composite, which is full of tech and other high-growth stocks, is on track for its worst week since March.

High rates drag down inflation by intentionally slowing the economy and denting prices for investments. They also take a notoriously long time to take full effect and can cause damage in unexpected, far-ranging corners of the economy. Earlier this year, high rates helped lead to three high-profile collapses of U.S. banks.

A report on Friday suggested business activity across the economy is stagnating. A preliminary measure of output compiled by S&P Global slipped to a seven-month low as businesses in services industries lost momentum. Demand was muted for both services and manufacturing providers.

Brasil Últimas Notícias, Brasil Manchetes

Similar News:Você também pode ler notícias semelhantes a esta que coletamos de outras fontes de notícias.

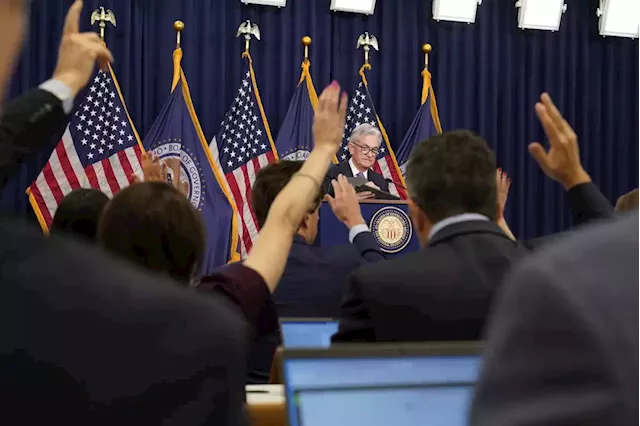

Stock market today: Wall Street slumps after Fed warns rates may stay higher through 2024NEW YORK (AP) — U.S. stocks slumped after the Federal Reserve said it may not cut interest rates next year by as much as it earlier thought, regardless of how much Wall Street wants it. The S&P 500 fell 0.9% Wednesday.

Stock market today: Wall Street slumps after Fed warns rates may stay higher through 2024NEW YORK (AP) — U.S. stocks slumped after the Federal Reserve said it may not cut interest rates next year by as much as it earlier thought, regardless of how much Wall Street wants it. The S&P 500 fell 0.9% Wednesday.

Fonte: SooToday - 🏆 8. / 85 Consulte Mais informação »

Stocks retreat as Wall Street braces for 'higher for longer' rates: Stock market news todayUS stocks were poised to continue their retreat on Thursday as investors worried over the Fed's hawkish stance.

Stocks retreat as Wall Street braces for 'higher for longer' rates: Stock market news todayUS stocks were poised to continue their retreat on Thursday as investors worried over the Fed's hawkish stance.

Fonte: YahooFinanceCA - 🏆 47. / 63 Consulte Mais informação »

Stock market today: Asian shares mixed after interest rates-driven sell-off on Wall StreetAsian shares were mixed on Friday after another slump on Wall Street driven by expectations that U.S. interest rates will stay high well into next year. Hong Kong and Shanghai advanced while Tokyo, Seoul and Sydney declined. U.S. futures edged higher and oil prices rose. Japan’s central bank kept its benchmark interest rate at minus 0.1%, as expected, but pledged flexibility in its policies. “Japan's economy is likely to continue recovering moderately for the time being, supported by factors suc

Stock market today: Asian shares mixed after interest rates-driven sell-off on Wall StreetAsian shares were mixed on Friday after another slump on Wall Street driven by expectations that U.S. interest rates will stay high well into next year. Hong Kong and Shanghai advanced while Tokyo, Seoul and Sydney declined. U.S. futures edged higher and oil prices rose. Japan’s central bank kept its benchmark interest rate at minus 0.1%, as expected, but pledged flexibility in its policies. “Japan's economy is likely to continue recovering moderately for the time being, supported by factors suc

Fonte: YahooFinanceCA - 🏆 47. / 63 Consulte Mais informação »

Stock market today: Wall Street holds a bit steadier as it closes out an ugly weekNEW YORK (AP) — Wall Street’s ugly week is getting a bit of a reprieve, and stocks are holding steadier on Friday, but it’s still heading for its worst week in six months. The S&P 500 was 0.

Stock market today: Wall Street holds a bit steadier as it closes out an ugly weekNEW YORK (AP) — Wall Street’s ugly week is getting a bit of a reprieve, and stocks are holding steadier on Friday, but it’s still heading for its worst week in six months. The S&P 500 was 0.

Fonte: SooToday - 🏆 8. / 85 Consulte Mais informação »

Stock market reaction to Fed is overdone, Wall Street bull saysStocks sold off for two days following the Federal Reserve meeting but one strategist believes higher interest rates might not be so bad for stocks.

Stock market reaction to Fed is overdone, Wall Street bull saysStocks sold off for two days following the Federal Reserve meeting but one strategist believes higher interest rates might not be so bad for stocks.

Fonte: YahooFinanceCA - 🏆 47. / 63 Consulte Mais informação »

Stock losses deepen as Wall Street braces for 'higher for longer' interest rates: Stock market news todayUS stocks continued their retreat on Thursday as investors worried over the Fed's hawkish stance.

Stock losses deepen as Wall Street braces for 'higher for longer' interest rates: Stock market news todayUS stocks continued their retreat on Thursday as investors worried over the Fed's hawkish stance.

Fonte: YahooFinanceCA - 🏆 47. / 63 Consulte Mais informação »