Tom Cahill, the co-head of tactical investing at Morgan Stanley Investment Management, sees “some interesting credit opportunities” opening up for investors as companies need to refinance their borrowings in a higher-interest rate environment.

Of course, rising interest rates have triggered a major readjustment in asset values, particularly in markets such“Real estate has always been affected by interest rates,” Cahill says. “Also there has been a massive shift in the post-COVID world. Where do you really need people to go into the office five days a week? If that is a permanent shift, that asset could potentially be worth less.”

“And then I might move up or down the capital structure depending on the answers to all those questions.” So what sort of returns can investors now earn from investing in corporate credit? Cahill says that, in the North American market, “most senior debt securities – either a bond or a leveraged loan – will be in the zip code right now of between 8 and 10 per cent. That’s pretty much the norm”.

“One of the things that needs to be kept in mind is that you have both the public markets, and you have the private markets and I think there’s going to be greater divergence between those two markets over time,” he says.In public markets over the past decade, “the covenants, the protections to investors, have been competed away quite dramatically”.

“ the protective measures in private credit have historically always been more fulsome than the public markets and I think they’re going to become a lot more fulsome.”Cahill points out that it’s expensive for private companies to issue public securities, and the debt raising has to be of a certain size.

Brasil Últimas Notícias, Brasil Manchetes

Similar News:Você também pode ler notícias semelhantes a esta que coletamos de outras fontes de notícias.

Companies set to pay employees working from home differentlyLaw firm Herbert Smith Freehills has found 37 per cent of Australian companies plan to pay employees differently if they choose to work from home, while 83 per cent expect their staff to spend more time in the office over the next two years.

Companies set to pay employees working from home differentlyLaw firm Herbert Smith Freehills has found 37 per cent of Australian companies plan to pay employees differently if they choose to work from home, while 83 per cent expect their staff to spend more time in the office over the next two years.

Fonte: SkyNewsAust - 🏆 7. / 78 Consulte Mais informação »

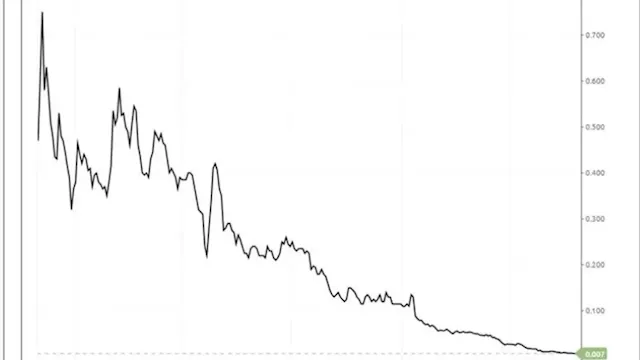

Rise in 'Zombie Companies' Threatens Australian EconomyData from KPMG reveals a concerning increase in 'zombie companies' in Australia, which are teetering on the edge of financial ruin. The number of publicly-listed companies in this category has risen by 51% in the past six months alone.

Rise in 'Zombie Companies' Threatens Australian EconomyData from KPMG reveals a concerning increase in 'zombie companies' in Australia, which are teetering on the edge of financial ruin. The number of publicly-listed companies in this category has risen by 51% in the past six months alone.

Fonte: newscomauHQ - 🏆 9. / 77 Consulte Mais informação »

Companies Using Fear of Human Extinction to Push for AI RegulationTop AI expert warns that big tech companies are spreading the false idea that AI could lead to human extinction in order to promote heavy regulation and stifle competition in the AI market.

Companies Using Fear of Human Extinction to Push for AI RegulationTop AI expert warns that big tech companies are spreading the false idea that AI could lead to human extinction in order to promote heavy regulation and stifle competition in the AI market.

Fonte: FinancialReview - 🏆 2. / 90 Consulte Mais informação »

How one of the 'bloke-iest' companies in Australia is smashing the gender pay gapIn early 2024, more than 4.6 million workers are about to find out how much less the company they work for pays female staff. Many companies are working now to fix the problem.

How one of the 'bloke-iest' companies in Australia is smashing the gender pay gapIn early 2024, more than 4.6 million workers are about to find out how much less the company they work for pays female staff. Many companies are working now to fix the problem.

Fonte: abcnews - 🏆 5. / 83 Consulte Mais informação »