US Envoy Brings Biden’s Latin America Investment Plan to RegionLagarde Says ECB Will Get Inflation Down to 2% Target in 2025Ford Otomotiv Boosts Capacity With 1 Billion Euro InvestmentBuffett’s Cash Pile Hits Record $157 Billion Amid Scarce DealsChina’s Sinopec, QatarEnergy Sign 27-Year LNG Supply DealFormer Crypto Day Traders Say No Thanks Even as Bitcoin Roars BackVedanta Posts Loss on Higher Tax Outgo and Weak Zinc PricesBritish Steel May get £500 Million Taxpayer SupportTwo Fuels That...

counterparts: TMU studyFinancial planning for raising kids: expert says cash flow is keyFinancial stress levels climb as Canadians use debt to pay for essentialsEmployers set aside less for 2024 pay increases: surveyBank of Canada rate pause opens sweet spot for savers: Dale JacksonCharting the Global Economy: Fed, BOE Leave Rates UnchangedS&P 500 notches best week in 2023 as yields tumbleCapital One Seeks to Offload More NYC Commercial-Property LoansEuropean Bank Watchdogs Eye Possible...

Brasil Últimas Notícias, Brasil Manchetes

Similar News:Você também pode ler notícias semelhantes a esta que coletamos de outras fontes de notícias.

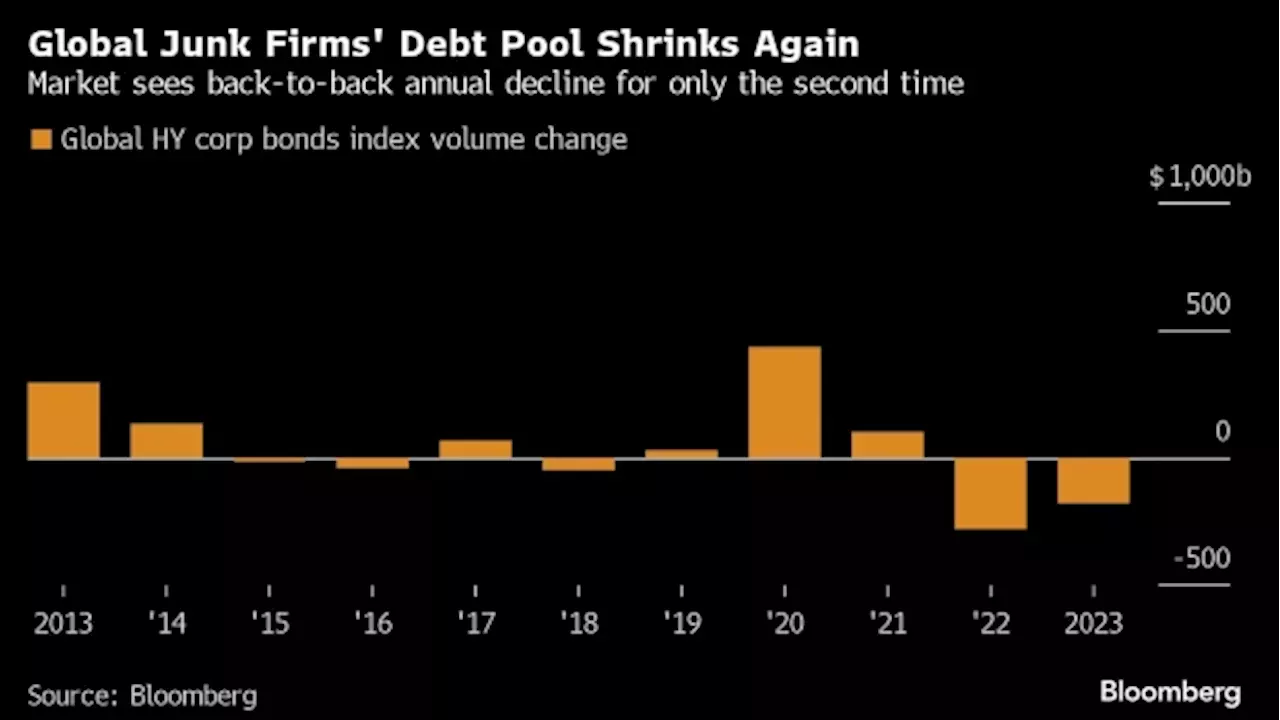

Junk Debt Market Shrinks as Maturity Wall Looms: Credit Weekly(Bloomberg) -- The global pile of junk-rated corporate debt is on track to shrink for a second consecutive year, with appetite for the risky securities...

Junk Debt Market Shrinks as Maturity Wall Looms: Credit Weekly(Bloomberg) -- The global pile of junk-rated corporate debt is on track to shrink for a second consecutive year, with appetite for the risky securities...

Consulte Mais informação »