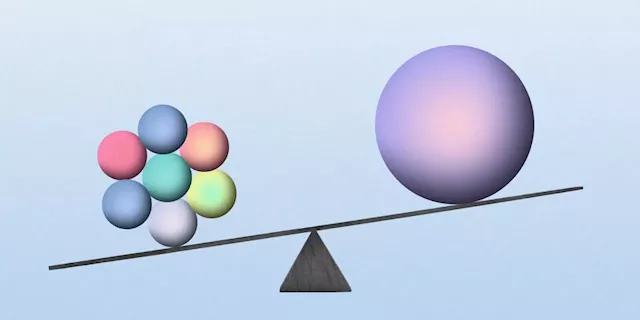

It’s a lopsided world. Stock markets are a seesaw with the so-called Magnificent Seven on one side and everything else on the other side. That presents a “once in a generation opportunity” in everything except those companies, says Richard Bernstein Advisors.

“People like the seven stocks simply because the stocks are going up, not that there’s any fundamental reason behind them,” Richard Bernstein, RBA’s CEO and chief investment officer, told Barron’s. “That says that there’s got to be opportunities elsewhere.” In fact, corporate profits are accelerating and the overall economy looks set to remain quite healthy, according to RBA, which manages more than $15 billion using global macro-based strategies and investing primarily in exchange-traded funds.

That suggests “there is nothing particularly magnificent about the Magnificent Seven,” the firm said. “Such narrow leadership seems totally unjustified and their extreme valuations suggest a once-in-a-generation opportunity in virtually anything other than those seven stocks.”

Brasil Últimas Notícias, Brasil Manchetes

Similar News:Você também pode ler notícias semelhantes a esta que coletamos de outras fontes de notícias.

Apple, Tesla, and the Rest of the Big 7 Stocks Have Been Winners. Now It's Time for the Others.Corporate profits are accelerating, providing lots of opportunities beyond the Magnificent Seven big tech stocks.

Apple, Tesla, and the Rest of the Big 7 Stocks Have Been Winners. Now It's Time for the Others.Corporate profits are accelerating, providing lots of opportunities beyond the Magnificent Seven big tech stocks.

Consulte Mais informação »