Last week, before the global market meltdown, three dozen luminaries of American finance gathered for a summer lunch, where they conducted informal polls about the outlook. The results were pretty dull. The majority at the table voted for a so-called “soft landing” for the US economy, with rates of 3-3.5 per cent in a year’s time, and a swing of 10 per cent, or less, for stock prices .

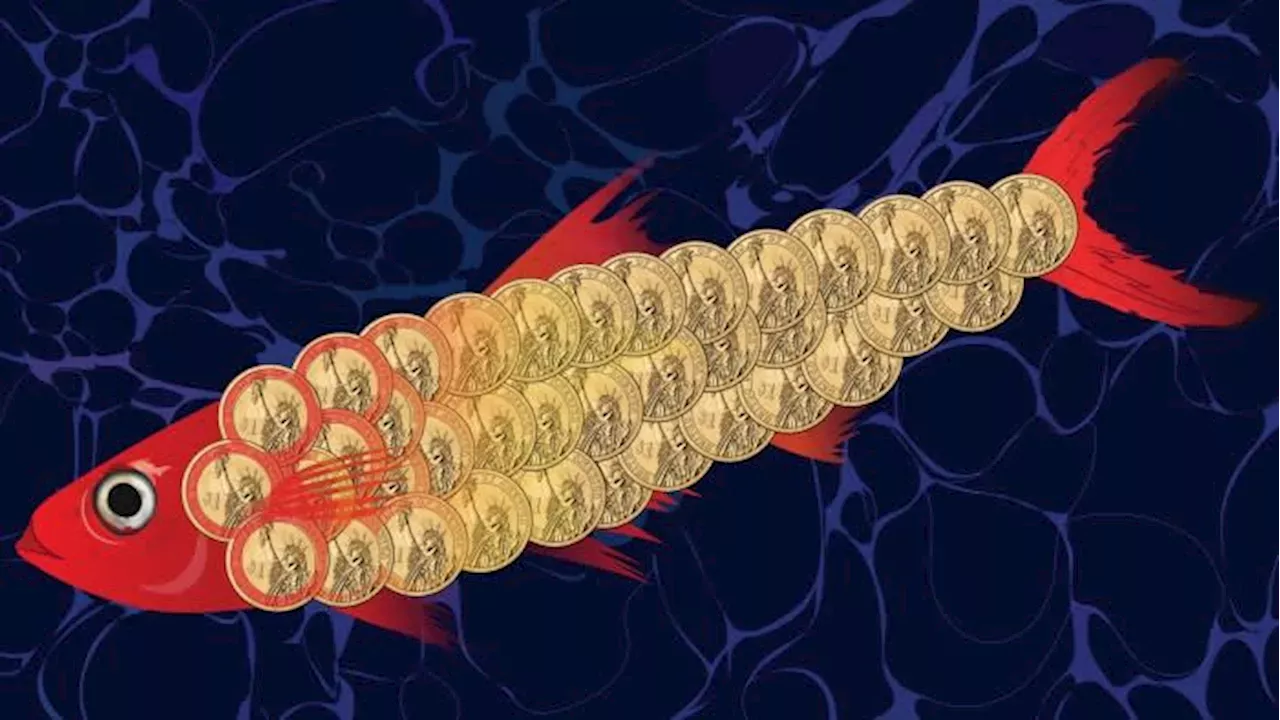

The Bank for International Settlements reports that cross-border yen borrowing rose $742bn since late 2021 and banks such as UBS estimate there was around $500bn in outstanding cumulative carry trades earlier this year. UBS and JPMorgan also think that about half of these have been unwound. But analysts disagree on how far these trades pumped up US tech stocks, and thus account for recent declines.

Brasil Últimas Notícias, Brasil Manchetes

Similar News:Você também pode ler notícias semelhantes a esta que coletamos de outras fontes de notícias.

Former Market Drayton police officer charged with misconductA former Market Drayton police officer has been charged with misconduct in public office.

Former Market Drayton police officer charged with misconductA former Market Drayton police officer has been charged with misconduct in public office.

Consulte Mais informação »

MP Materials Q2 2024 results show impact of slowing rare earths marketNdPr realised price at $48/kg for the quarter

MP Materials Q2 2024 results show impact of slowing rare earths marketNdPr realised price at $48/kg for the quarter

Consulte Mais informação »

'Fantastic' three bedroom house on the market for £160kThe terraced house is a lot bigger than it looks on the inside

'Fantastic' three bedroom house on the market for £160kThe terraced house is a lot bigger than it looks on the inside

Consulte Mais informação »

Preston Market Hall door repair looks finally to be doneThe entrance was damaged when it was hit by a car Work on the damaged Preston Market Hall entrance is set to be finished within days. The entrance from E

Preston Market Hall door repair looks finally to be doneThe entrance was damaged when it was hit by a car Work on the damaged Preston Market Hall entrance is set to be finished within days. The entrance from E

Consulte Mais informação »

Deep fryer explodes at Plymouth Market Basket, burning 3 people including infantThe Plymouth Fire Department says a 79-year-old customer, an 11-month-old child and a 31-year-old Market Basket employee were injured in the incident at the…

Deep fryer explodes at Plymouth Market Basket, burning 3 people including infantThe Plymouth Fire Department says a 79-year-old customer, an 11-month-old child and a 31-year-old Market Basket employee were injured in the incident at the…

Consulte Mais informação »

Pretty English market town is home to European-style flower attraction and overlooked lido...Underrated towns you need to visit

Pretty English market town is home to European-style flower attraction and overlooked lido...Underrated towns you need to visit

Consulte Mais informação »