--

Currency swings “could potentially be the difference between a positive earnings season and a negative earnings season,” said Michael Field, European strategist at Morningstar. Companies are likely to remain wary of yen appreciation and may also lower earnings guidance, said JPMorgan strategists including Rie Nishihara.

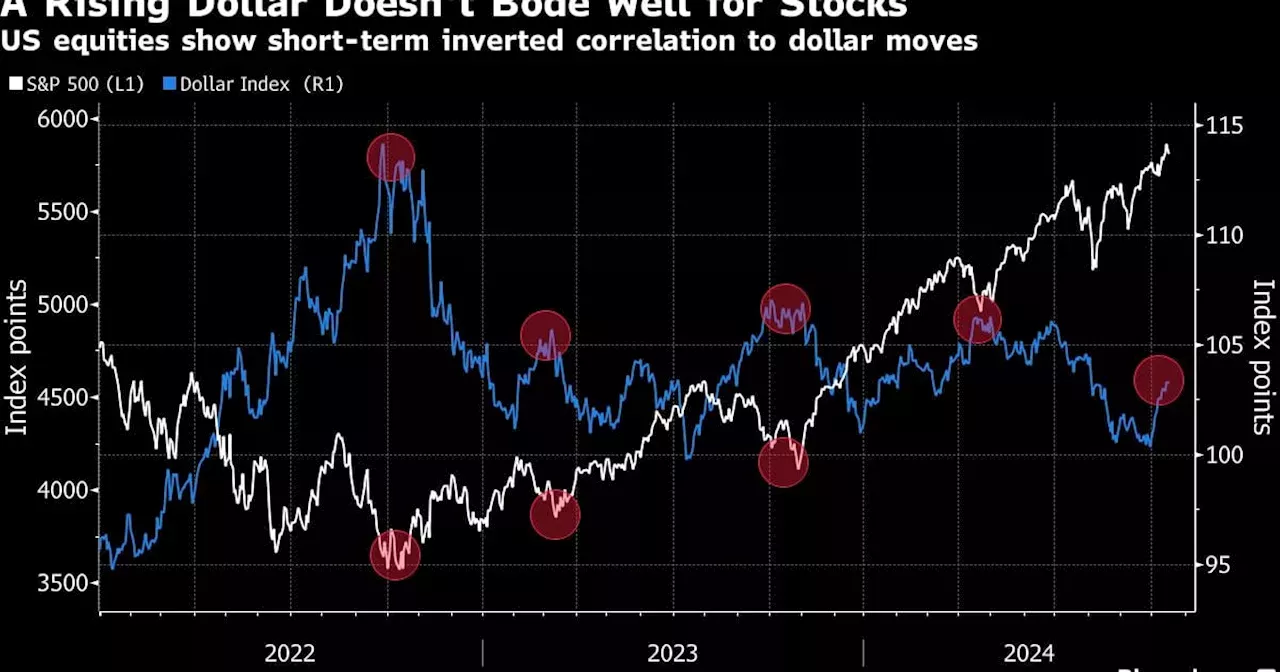

Wall Street economists expect that a win for Donald Trump in next month’s US election would support the dollar, as his trade policies would potentially drive up inflation and interest rates. A prolonged trade war would also weigh on global risk sentiment, further supporting haven demand for the currency.

In Europe, several corporates have already raised currency-related losses at the start of the earning season, including warnings from British American Tobacco Plc and rival Imperial Brands Plc.

Brasil Últimas Notícias, Brasil Manchetes

Similar News:Você também pode ler notícias semelhantes a esta que coletamos de outras fontes de notícias.

Premarket: Global stocks bask in China stimulus glowYen swings higher on Ishiba win

Premarket: Global stocks bask in China stimulus glowYen swings higher on Ishiba win

Consulte Mais informação »