Conveyancer Natalie Fisher still feels violated when she thinks about the criminals who watched her for weeks or months, taking note of her digital mannerisms while plotting an attack.

Once the hackers had access to the systems, they diverted client emails and responded on Fisher’s behalf. “It was like a three-way conversion that I was no longer a part of anymore,” she says. “I said forward me the emails so I can understand what you’re talking about,” she says. “When I saw the emails and he told me what he’d done, I felt so sick.”

“If I didn’t have this policy, it would have ruined me. Not just financially but, my reputation, everything,” Fisher says.The coronavirus pandemic has led to an explosion in online scams, fraud and cyber attack. The proliferation of remote working has coincided with the mass release of cheap malware on the dark web, which has created a perfect storm for an uptick in illegal online activity.

But as demand grows, Butler says the industry has had to adapt quickly. “All insurers are currently grappling with how they write cyber,” Butler says. “The biggest issue for them is the systemic nature of cyber.”Insurance companies are in the business of pricing risk. Premiums are calculated using historical data patterns to estimate the size and cost of claims. Insurers have well-established processes for vehicle and property damage, but with cyber, Butler says the rules are largely unwritten.

Many insurers have introduced limits on payouts and created eligibility criteria to ensure policyholders have basic defences in place, such as multi-factor authentication, data backups and staff training.

Business Business Latest News, Business Business Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

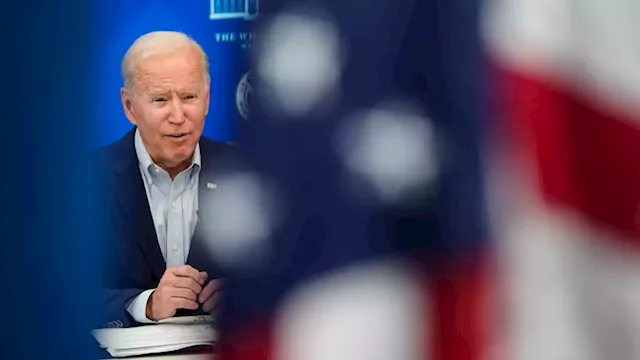

Biden targets meatpacking companies amid rising food pricesJoe Biden ….Oh the web we weave……you JoeBiden wove.deceptive MUCH Pricing. If an economy is an efficient machine, which is also a system, what does the pricing system look like, and how much does it matter? This is where private business, is actually national produce. And I guess it’s just a coincidence that every other country in the world has the same problems.. 🤪🤡

Biden targets meatpacking companies amid rising food pricesJoe Biden ….Oh the web we weave……you JoeBiden wove.deceptive MUCH Pricing. If an economy is an efficient machine, which is also a system, what does the pricing system look like, and how much does it matter? This is where private business, is actually national produce. And I guess it’s just a coincidence that every other country in the world has the same problems.. 🤪🤡

Read more »