Michael Arone, chief investment strategist at State Street Global Advisors, said investors are also realizing that earnings are not as robust as they had been.

"When the street and market makers are no longer long short-term volatility, when they can't afford to hold it because it's way too expensive, market makers are no longer there to cushion the blow, and that's when it gets wild," he said. The 200-day moving average is viewed as an important momentum indicator. A drop below it for a sustained period suggests more downside, and a break above it could indicate a bigger up move is ahead.

Stovall said a key metric to watch is the course of the 10-year Treasury yield, an important benchmark that influences mortgages and other lending rates. On Friday afternoon, it was at 1.78%, off its highs for the week. The yield also influences investors' views of the valuations of stocks.

Business Business Latest News, Business Business Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

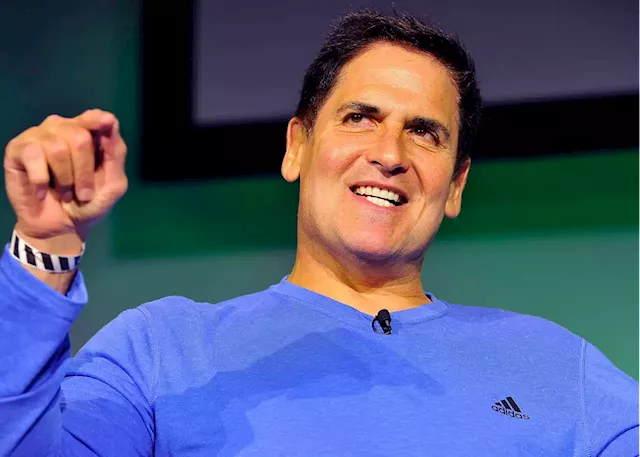

How Mark Cuban's Cost Plus Drug Company Could Disrupt 'Big Pharma'With his new company, Mark Cuban wants to disrupt big pharma by offering medicines for a much more affordable price. But will it work? It already has. My son’s meds are $274 for 90 days. Through Cuban’s company, it will be $8.40 for a 90 day supply. Thanks mcuban ! I’m sorry about you & your married. Married is over & over it….over………My son & over & over at all…..

How Mark Cuban's Cost Plus Drug Company Could Disrupt 'Big Pharma'With his new company, Mark Cuban wants to disrupt big pharma by offering medicines for a much more affordable price. But will it work? It already has. My son’s meds are $274 for 90 days. Through Cuban’s company, it will be $8.40 for a 90 day supply. Thanks mcuban ! I’m sorry about you & your married. Married is over & over it….over………My son & over & over at all…..

Read more »