. The Consumer Price Index, which tracks a basket of goods and services, jumped 8.5% in March from a year ago.

To help arrest that surge, the Fed has already announced a quarter-percentage point rate hike. Wall Street analysts now expect a half-percentage rate hike at its next meeting in two weeks. Other central banks have also moved to raise interest rates to try and temper the impact of In the past, the Fed has typically raised its benchmark short-term rate by more modest quarter-point increments.

"We continue to expect two 50-basis-point rate hikes in May and June," Rubeela Farooqi, chief U.S. economist at High Frequency Economics, said in a report."Any subsequent action will depend not only on the path of inflation but also the economy's response to rapid rate increases over the next few months."

Bond yields have been gaining ground as investors prepare for higher interest rates. The yield on the 10-year Treasury held steady on Friday at 2.92% after hovering near its highest levels since late 2018.

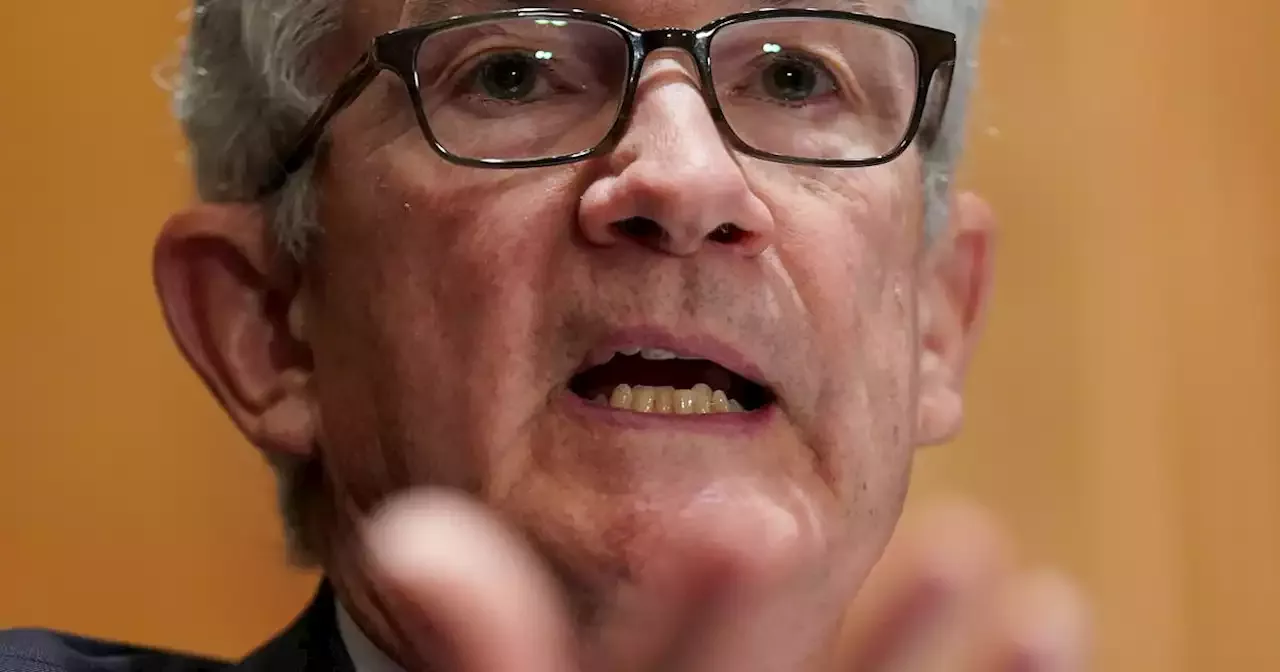

Jerome Powell fell asleep at the wheel and let inflation get out of hand… we need a new Fed chairman. There were warnings about inflation that he ignored last year.