“I got stopped out of a lot of long positions on Thursday and Friday of last week,” the chairman of the University of Akron Endowment told Bloomberg Radio on Monday. “I’m happy to be basically as flat as I’ve been in a long period of time.” Stopped out refers to the execution of a stop-loss order.

While Gartman, the former publisher of the influential “The Gartman Letter,” in the past said he was wrong about a bear market in“It could go quite a good deal farther to the downside,” he said. “The use of margin has been declining. That’s always one of the signs of a top in the market. Be careful. I think it goes down another 5%-10% from here. At least. Maybe more.

“I’ve been very consistent about that fact and actually had the university reduce the size of its portfolio 12% to 15% on Dec. 31 of last year,” he said. The Fed is widely anticipated to raise the overnight lending rate by 50 basis points next month, after a quarter-point increase earlier this year. Gartman in January said stocks could face a decline of as much as 15% in 2022. The Standard & Poor’s 500 Index is down 11% so far this year.

Business Business Latest News, Business Business Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Asian stocks slide as markets brace for rate hikesAsian stocks fell the most in two weeks on Monday as investors prepare for rapid US rate rises and slowing growth

Read more »

Business Maverick: Palm Oil Soars on Indonesia Ban in Risk to Global Food InflationPalm oil rallied after top producer Indonesia said it will ban all exports of cooking oil, a move that threatens to worsen global food inflation. orchestrated food shortages

Business Maverick: Palm Oil Soars on Indonesia Ban in Risk to Global Food InflationPalm oil rallied after top producer Indonesia said it will ban all exports of cooking oil, a move that threatens to worsen global food inflation. orchestrated food shortages

Read more »

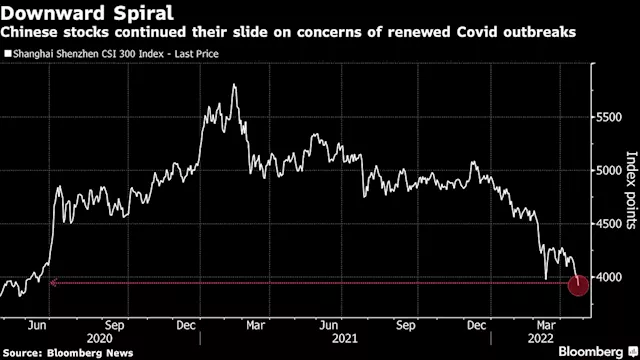

Business Maverick: China Lockdown Fears Rip Through Markets as Stocks, Yuan TumbleFears about the economic toll of China’s strict Covid Zero policy have intensified, as news that lockdowns were spreading to Beijing sent stocks, commodities and the yuan tumbling. Why hasnt china been sued and fined yet for causing worldwide deaths, eh?

Business Maverick: China Lockdown Fears Rip Through Markets as Stocks, Yuan TumbleFears about the economic toll of China’s strict Covid Zero policy have intensified, as news that lockdowns were spreading to Beijing sent stocks, commodities and the yuan tumbling. Why hasnt china been sued and fined yet for causing worldwide deaths, eh?

Read more »

Global stocks fall as recession fears growRelief over Emmanuel Macron’s French presidential election win gives way to renewed concerns about the impact of rising interest rates on the global economy

Read more »

Business Maverick: New Texts Shed Light on Elon Musk’s 2018 Spat With Saudi FundElon Musk’s short-lived effort to take Tesla Inc private after his infamous “funding secured” tweet in August 2018 has loomed over the billionaire’s reputation – and his quest to buy Twitter Inc. Trash journalism

Business Maverick: New Texts Shed Light on Elon Musk’s 2018 Spat With Saudi FundElon Musk’s short-lived effort to take Tesla Inc private after his infamous “funding secured” tweet in August 2018 has loomed over the billionaire’s reputation – and his quest to buy Twitter Inc. Trash journalism

Read more »