while the Nasdaq Composite plummeted 4.99%, with both drops marking the worst losses in a single day since 2020. The S&P 500 slipped 3.56%, recording its second-to-worst day in 2022.raised interest rates by 50 basis points and said it will begin tightening its balance sheet in June.

"Right now, I think the market's anticipating the worst-case scenario and there's a good chance that we actually don't get it," Cramer said of the Fed's inflation-fighting measures. He added that curious investors should ask themselves several questions to gauge the state and future of the market. Here are some of the notable questions Cramer outlined:Cramer said the answer is no."If you take your cue only from the bond market, we're headed for a high-inflation world where the Fed has to raise rates aggressively. That means you should buy stocks that do well … in a high-inflation slowdown," he said.

Business Business Latest News, Business Business Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

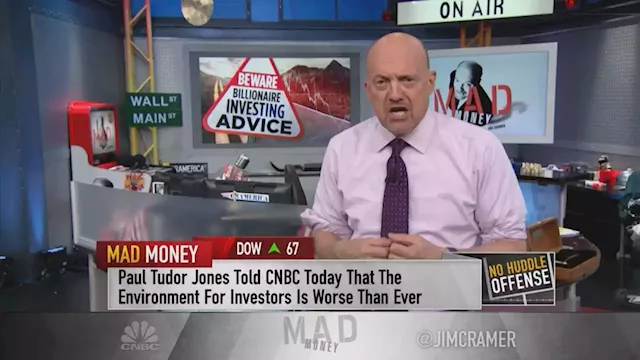

Jim Cramer explains why owning stocks is 'worth the risk' right nowCNBC's Jim Cramer explained on Tuesday's episode of 'Mad Money' why investors shouldn't sell off all their stocks despite the current market turbulence. Jinxed Great as if we didn’t have enough headwinds holding us back. The Paradox of Investing - It is to be greedy when people are fearful and fearful when people are greedy.

Jim Cramer explains why owning stocks is 'worth the risk' right nowCNBC's Jim Cramer explained on Tuesday's episode of 'Mad Money' why investors shouldn't sell off all their stocks despite the current market turbulence. Jinxed Great as if we didn’t have enough headwinds holding us back. The Paradox of Investing - It is to be greedy when people are fearful and fearful when people are greedy.

Read more »

Jim Jordan questions FTC chief over ex-employer's call for agency to block Musk's Twitter acquisitionRep. Jim Jordan sent a letter to FTC Chair Lina Khan on Wednesday, questioning whether she has taken action on her former employer's calls for her agency to block Elon Musk's pending purchase of Twitter.

Jim Jordan questions FTC chief over ex-employer's call for agency to block Musk's Twitter acquisitionRep. Jim Jordan sent a letter to FTC Chair Lina Khan on Wednesday, questioning whether she has taken action on her former employer's calls for her agency to block Elon Musk's pending purchase of Twitter.

Read more »