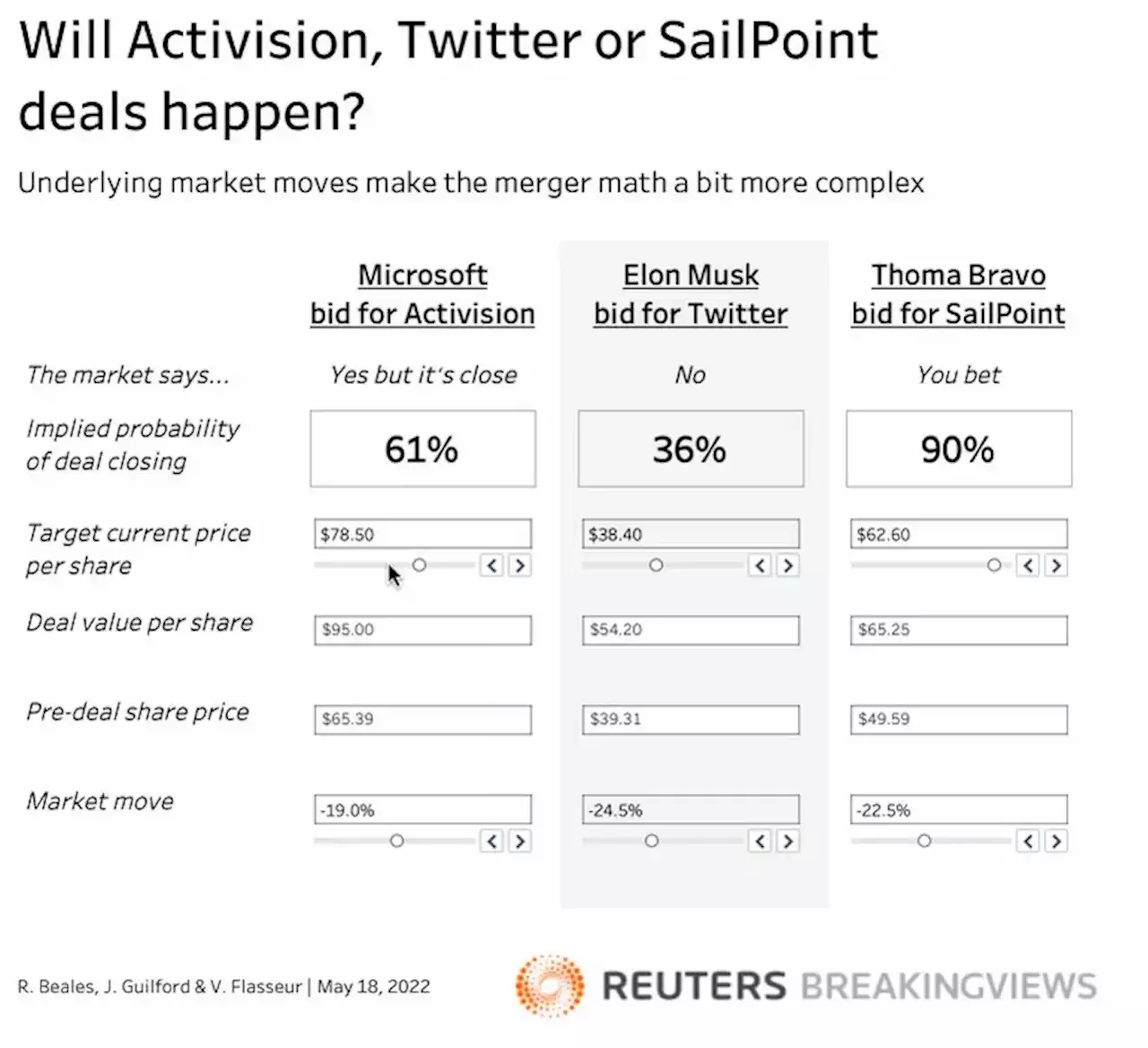

. Investors must price in the risk that merger-phobic regulators block the deal. But that risk hasn’t really changed since the tie-up’s announcement, while Activision’s shares have trended downwards. What has changed is the carnage in the stock market.

Here's how the math works. Arbitrage-focused hedge funds look to balance the probability a deal will close – and the payoff they’ll receive if it does – against where a stock would probably trade if the takeover fails. Microsoft is offeringfor Activision. The stock closed at $65.39 before the transaction became public. Assuming Activision fell back to that price if regulators block the merger, its closing price of $78.

Not so for Twitter. Even considering the nearly 25% decline in the Dow Jones Internet Index since just before Musk made his investment in the company public ahead of announcing his $54.20-a-share offer, its Tuesday closing price of $38.32 implies only around 36% odds that the deal will close. That may even be optimistic: One possibility is that Twitter accepts a lower bid.

$6.9 billion sale to Thoma Bravo. Those moves may be about increasing risks to investors, rather than the deals themselves.

Business Business Latest News, Business Business Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Market rout throws off math for open dealsUnlike Twitter, whose shares dived on Elon Musk’s waning enthusiasm for his $44 bln offer, other stocks pending a deal are down on little news. Market pain changes the math for arbitrageurs as target shares may drop further if mergers fail. A Breakingviews calculator shows how.

Market rout throws off math for open dealsUnlike Twitter, whose shares dived on Elon Musk’s waning enthusiasm for his $44 bln offer, other stocks pending a deal are down on little news. Market pain changes the math for arbitrageurs as target shares may drop further if mergers fail. A Breakingviews calculator shows how.

Read more »

5 Things to Know Before the Stock Market Opens WednesdayU.S. stock futures dropped Wednesday as rising inflation slammed another retailer.

5 Things to Know Before the Stock Market Opens WednesdayU.S. stock futures dropped Wednesday as rising inflation slammed another retailer.

Read more »

Anchorage Market opens for the summer with Fair ridesThe Anchorage Market opened this weekend with fair rides, and will be open Fridays, Saturdays and Sundays throughout the summer in the south lot of the Dimond Center. Sweet can’t wait Great. Awesome locations for tourists to find it Hotels in midtown, market at Dimond and meanwhile our city center is going to crap

Anchorage Market opens for the summer with Fair ridesThe Anchorage Market opened this weekend with fair rides, and will be open Fridays, Saturdays and Sundays throughout the summer in the south lot of the Dimond Center. Sweet can’t wait Great. Awesome locations for tourists to find it Hotels in midtown, market at Dimond and meanwhile our city center is going to crap

Read more »