This was supposed to be a blowout year for Canadian equities, benefiting from soaring commodity prices and a forceful post-pandemic rebound in consumer spending. Instead, the country’s benchmark index is slumping amid the global stock selloff, though not as badly as its US counterpart.

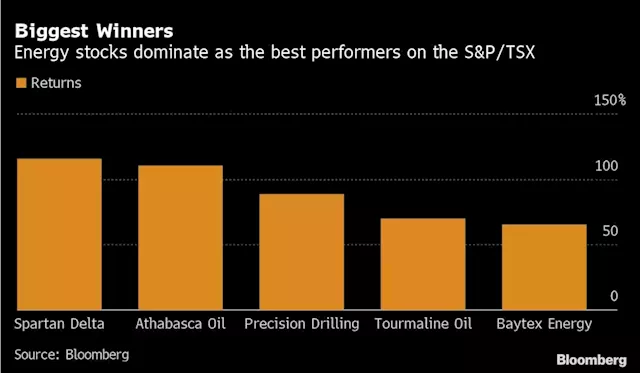

Soaring oil prices boosted energy stocks, which are up 24 per cent this year. Oil and gas stocks may have more room to run. Earnings in the sector are expected to skyrocket, with the blended forward 12-month average earnings per share expected to jump 59 per cent, compared with 30 per cent for the S&P/TSX and 20 per cent for the S&P 500, according to Bloomberg data.

Meanwhile, financial stocks have spiraled as rising interest rates and record inflation spook investors. Banks and insurers, which make up nearly one-third of the broader market, have weighed on the benchmark.

The last time oil was this high, the CAD was worth more than the USD and my PM portfolio was at ATH. Today, pffffff. What gives?

Business Business Latest News, Business Business Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

From Suncor to Shopify, Canada Stocks Whipsaw on Recession Fears(Bloomberg) -- This was supposed to be a blowout year for Canadian equities, benefiting from soaring commodity prices and a forceful post-pandemic rebound in consumer spending. Instead, the country’s benchmark index is slumping amid the global stock selloff, though not as badly as its US counterpart.Most Read from BloombergStock Doomsayers Vindicated in Historic First Half: Markets WrapThe Wheels Have Come Off Electric VehiclesDemocrats Weigh Paring Biden Tax Hike to Win Over ManchinSupreme Cour

From Suncor to Shopify, Canada Stocks Whipsaw on Recession Fears(Bloomberg) -- This was supposed to be a blowout year for Canadian equities, benefiting from soaring commodity prices and a forceful post-pandemic rebound in consumer spending. Instead, the country’s benchmark index is slumping amid the global stock selloff, though not as badly as its US counterpart.Most Read from BloombergStock Doomsayers Vindicated in Historic First Half: Markets WrapThe Wheels Have Come Off Electric VehiclesDemocrats Weigh Paring Biden Tax Hike to Win Over ManchinSupreme Cour

Read more »

Weakness in energy stocks 'attractive opportunity': Credit Suisse - BNN BloombergThe recent underperformance in the energy sector has led one analyst to make a bullish call on the industry.

Weakness in energy stocks 'attractive opportunity': Credit Suisse - BNN BloombergThe recent underperformance in the energy sector has led one analyst to make a bullish call on the industry.

Read more »