The document’s hawkish tone suggests that the bank is prioritizing its fight against inflation over economic growth and, therefore, may be prepared to deliver another supersized 75 basis point hike at its November gathering if conditions warrant further front-loaded action.

Investors and traders will have a clearer picture of what to expect in terms of monetary policy tomorrow after the U.S. Bureau of Labor Statistics releases the. Annual headline inflation is forecast to moderate to 8.1% from 8.3%, but the core gauge is seen accelerating to 6.5% from 6.3% previously, matching the cycle’s high set in March.

For sentiment to recover and stocks to mount a meaningful recovery, the data has to surprise on the downside in a way that reduces pressure on the Fed to step up the pace of rate rises. In-line or above-estimate numbers could unleash a sell-off on Wall Street, as happened last month, whenImmediately after the Fed minutes crossed the wires, the S&P 500 pushed higher into positive territory, as the summarized record of the last FOMC meeting failed to deliver any new hawkish bombshells.

100 on the back of rapidly slowing economic activity, rising borrowing costs and heightened financial risks, but we should have a better idea of the near-term trend tomorrow after analyzing the September CPI numbers.

Business Business Latest News, Business Business Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

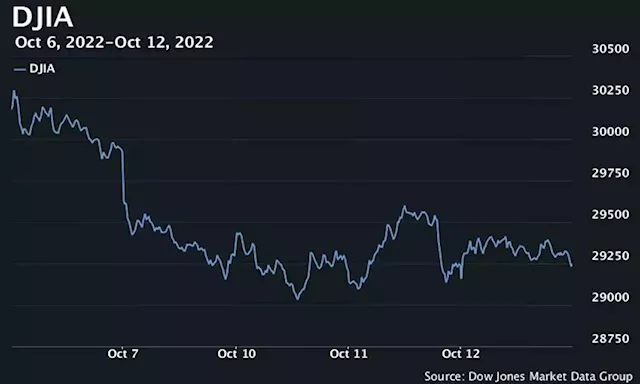

U.S. stocks surrender early gains to close lower after Fed minutes hint at more aggressive hikesU.S. stocks finished lower on Wednesday after the Fed’s September meeting minutes was released, where policy makers noted that inflation remained “unacceptably high.” The Dow Jones Industrial Average finished off 28.34 points, or 0.1%, at 29,210.85:

U.S. stocks surrender early gains to close lower after Fed minutes hint at more aggressive hikesU.S. stocks finished lower on Wednesday after the Fed’s September meeting minutes was released, where policy makers noted that inflation remained “unacceptably high.” The Dow Jones Industrial Average finished off 28.34 points, or 0.1%, at 29,210.85:

Read more »