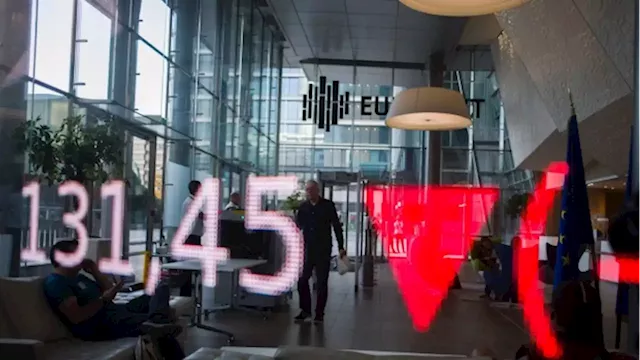

It’s hard to remember a time when the outlook for financial markets was more mixed. The economy is facing sky-high inflation, aggressive rate hikes by central banks, and the spectre of a recession; while bulls and bears are battling it out on equity markets.

As of the close of trading Friday, the main Canadian stock index had plunged 17 per cent to 18,326 since hitting a high of 22,087 on March 29. It would need to rally about 15 per cent to hit that 21,000 target by Dec. 31. The bear to Belski’s bull is David Rosenberg, the founder and president of Rosenberg Research. He says investors who jump into the market now will only watch their stocks dwindle in value until they hit bottom in 2024. that the stock market historically bottoms 16 months after the U.S. Federal Reserve pauses interest rate hikes. The Fed, along with other major central banks , has telegraphed that more rate hikes are coming because inflation is still a concern.

The VIX was established in Chicago; the epicentre of the global options market. It seeks to measure volatility using call and put prices in S&P 500 options. The options market is complicated — calls and puts are basically bets on the future price of stocks. The VIX turns those bets into a forecast of how those expectations jive with reality. When they don’t jive, and reality hits, you get the sort of volatility we’ve been seeing lately.

Monopoly US money at work.

Business Business Latest News, Business Business Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Oil edges higher after weekly loss as slowdown hangs over market - BNN BloombergOil wiped out early gains as fears over an economic slowdown continue to weigh on the outlook for demand.

Oil edges higher after weekly loss as slowdown hangs over market - BNN BloombergOil wiped out early gains as fears over an economic slowdown continue to weigh on the outlook for demand.

Read more »

Pound and U.K. bonds rally; U.S. stocks, futures advance - BNN BloombergThe pound rallied and U.K. bonds surged as more of Prime Minister Liz Truss’s package of unfunded tax cuts were reversed. Stocks rose, with investors preparing for a number of key earnings reports this week.

Pound and U.K. bonds rally; U.S. stocks, futures advance - BNN BloombergThe pound rallied and U.K. bonds surged as more of Prime Minister Liz Truss’s package of unfunded tax cuts were reversed. Stocks rose, with investors preparing for a number of key earnings reports this week.

Read more »

The Week Ahead: Earnings from Netflix, Bank of America; Canadian CPI data due - BNN BloombergA look at what investors will be watching in the week ahead.

The Week Ahead: Earnings from Netflix, Bank of America; Canadian CPI data due - BNN BloombergA look at what investors will be watching in the week ahead.

Read more »