The recent rebound in share prices of glove companies might be due to news regarding the Covid-19 XBB Omicron subvariant, as well as the continued weakness of the ringgit versus the US dollar, said a fund manager.

After hitting a seven-year low of 56.5 sen a share at the end of September, Top Glove shares have risen by some 30% to close at 74 sen yesterday adding some RM1.4bil in market capitalisation in the process helped partly by buying from founder and chairman Tan Sri Lim Wee Chai. While price charts suggest room for further upside for the glove stock in the short term, fundamentals of the sector remain bearish with market demand for gloves remains muted as glove distributors’ inventories remain elevated, and companies push back on their expansion plans, said RHB Research.

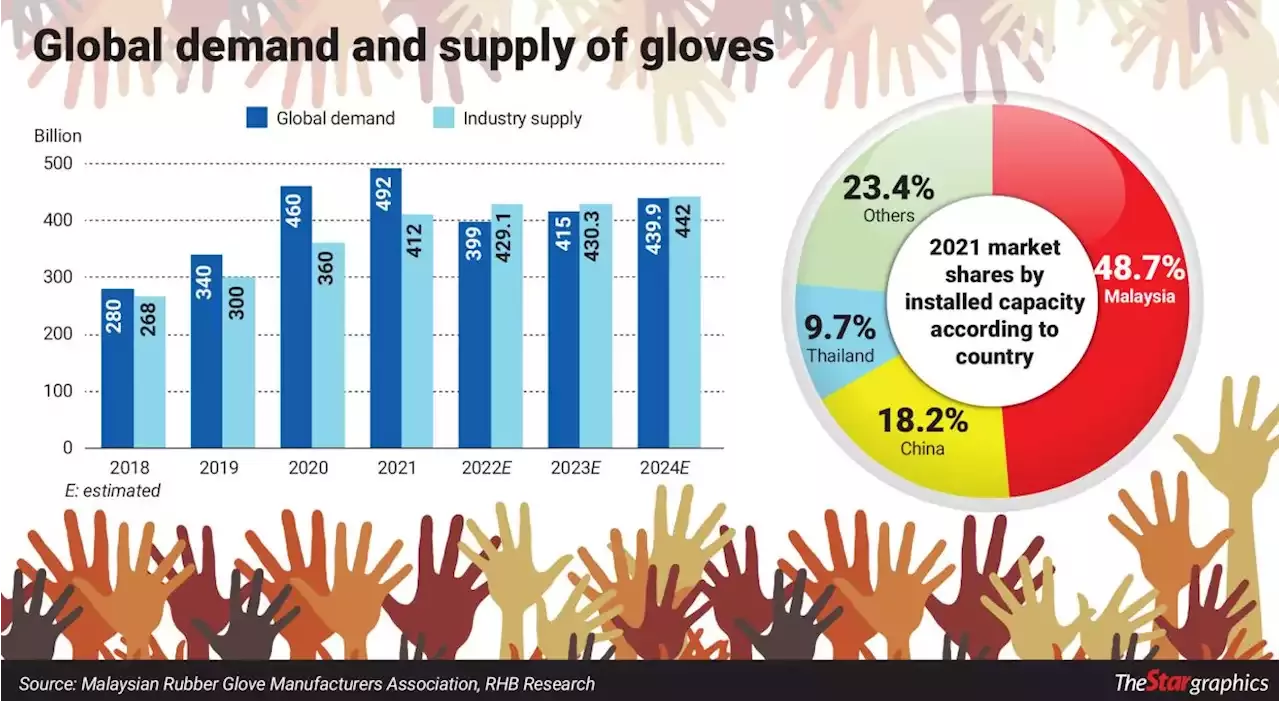

In the domestic market, rising input costs drove Top Glove to raise its ASP by 5% in order to maintain profitability in the near future. “We have conservatively estimated for demand to grow by only 4% year-on-year in 2023 underpinned by price stabilisation towards the first half of 2023. On a whole, the global supply of gloves is expected to not grow in 2023 and by 3% y-o-y in 2024, the research house predicted.