West Texas Intermediate futures dropped below US$89 a barrel after rising four per cent over the previous two sessions. Powell said it's “very premature to be thinking about pausing” after the Fed hiked rates again by 75 basis points. The dollar jumped, making commodities priced in the currency less attractive. Major central banks are seeking to tame rampant inflation, which is weighing on energy demand.

“Rising anxiety about stalling growth will inevitably impact global oil demand and another downward revision in the next set of forecasts is not a far-fetched idea,” said Tamas Varga, an analyst at brokerage PVM Oil Associates. “The battle between bearish demand outlook and bullish supply expectations intensifies.”

An uncertain outlook for China, the world's biggest crude importer, has added to headwinds for oil. The country's top health body said the nation's zero-tolerance approach remains the overall strategy to fighting COVID-19 after unverified social media posts buoyed hopes the policy would be eased. Oil has lost almost a third of its value since early June as concerns over a global economic slowdown filter through the market. Still, there is uncertainty about supply heading into winter, with OPEC+ implementing sizable output cuts and the European Union set to sanction Russia crude flows.WTI for December delivery declined 1.5 per cent to US$88.69 a barrel at 10:16 a.m. in London.The Middle Eastern Dubai crude benchmark has been pressured in recent days too.

Business Business Latest News, Business Business Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

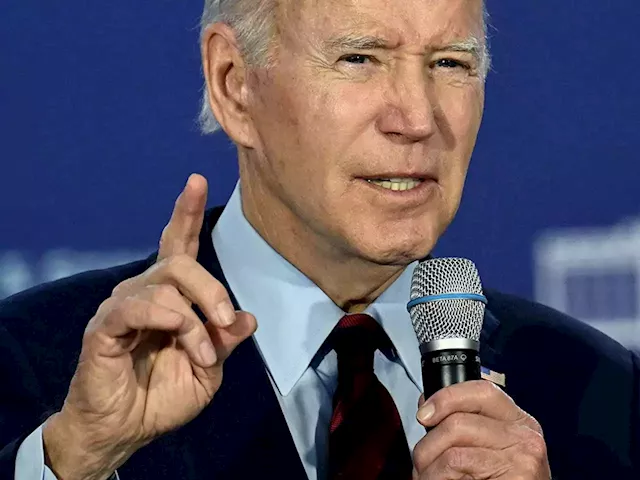

Rex Murphy: Energy crisis the inconvenient consequence of demonizing the oil and gas industryWhat did Joe Biden and others like him — including in Canada — expect to happen? Rex had a pet dinosaur growing up. Rex Murphy is on the fossil fuel gravy train. Something tells me that the big oil companies have their companies registered in Delaware for its generous treatment ,plus both Obama and Biden choose Tom Steyer,s massive donations to the Dems for shutting down Keystone TWICE.

Rex Murphy: Energy crisis the inconvenient consequence of demonizing the oil and gas industryWhat did Joe Biden and others like him — including in Canada — expect to happen? Rex had a pet dinosaur growing up. Rex Murphy is on the fossil fuel gravy train. Something tells me that the big oil companies have their companies registered in Delaware for its generous treatment ,plus both Obama and Biden choose Tom Steyer,s massive donations to the Dems for shutting down Keystone TWICE.

Read more »