The federal government between January and November of 2022 borrowed a sum of N2.94trillion through FGN Bond Market to finance the 2022 budget deficit, bond auction results released by the Debt Management Office has revealed.

The bond market offers less volatility that assures Pension Funds Administrators , and investors of their capital returns albeit with low yield on investment as the marginal rates on -Year Bond FGN Bonds that close the November 2022 auction was at 16.2 per cent, below 21.09 per cent inflation rate as of October 2022.

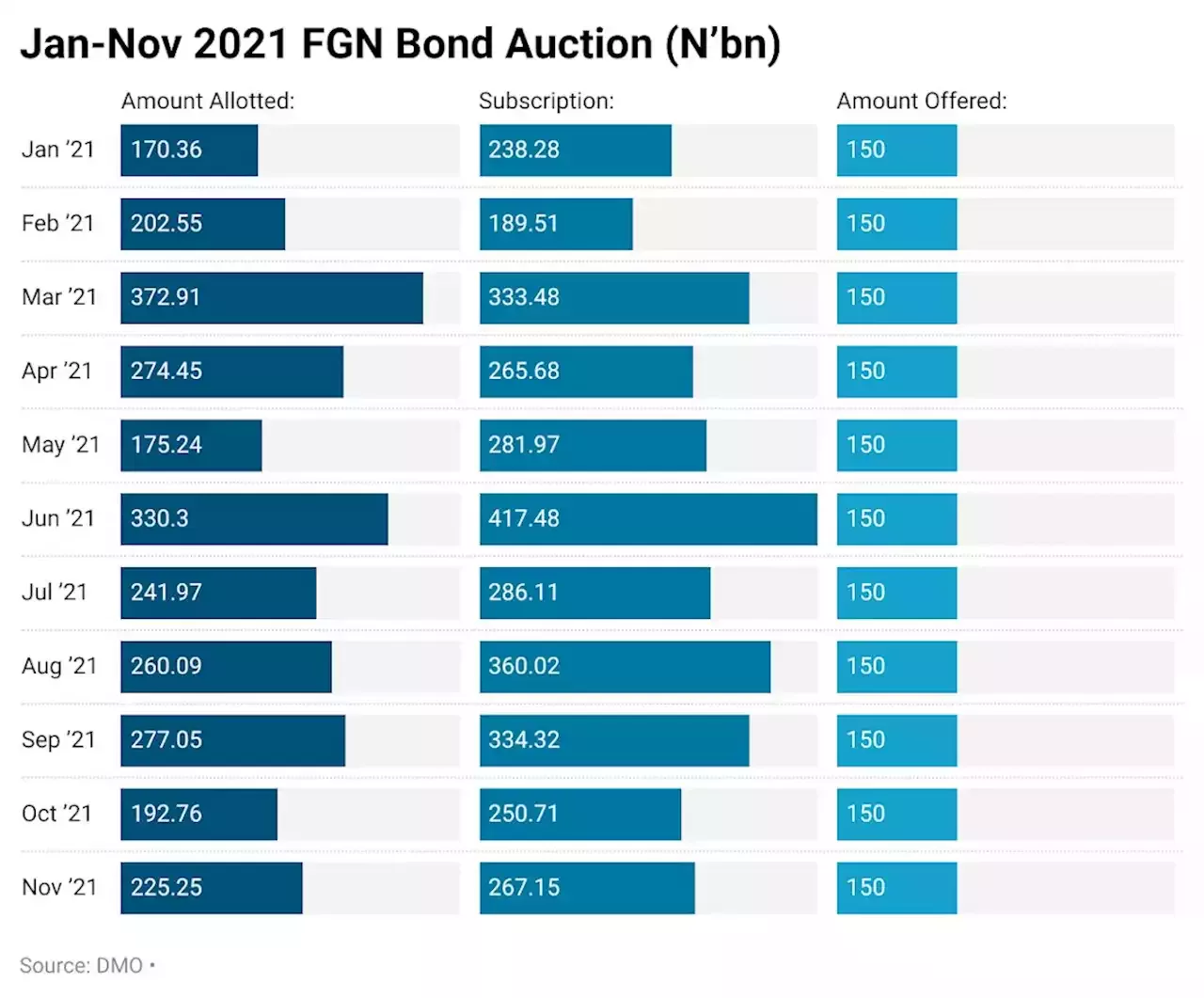

According to him, “This represents 63 per cent of the estimated deficit for the full year. This is largely attributable to revenue shortfalls and higher debt service obligations resulting from rising debt levels and interest rates. The latest FGN bond auction result for the month of November 2022 revealed that the DMO offered N225billion for subscription to investors but raised N344.01billion through re-openings of the 14.55 per cent FGN APR 2029, 12.50 per cent FGN APR 2032 and 16.25 per cent 2037 FGN bonds. The DMO finally allotted N269.15billion to investors in November.

He explained that, “the FGN bonds have no default risk, meaning that it is certain your interest and principal will be paid as and when due. The interest income earned from the securities are tax exempt compared to the treasury bills that expired in January 2022.” “The money spent on debt servicing is eating deep into the government’s revenue, which makes borrowing an unsustainable form of financing.”

Developed nations live on borrowed money for development. You have to be credit worthy to get money to borrow. Because financial institutions trust and know that Buhari will utilize loans judiciously they are willing to borrow his government money. Which is good for the country.