Third-quarter media earnings season has officially drawn to a close, and concerns about an uncertain macroeconomic future continued to reverberate throughout the sector.

It’s been six months since WarnerMedia and Discovery joined forces. As is typical with M&A deals, the acquirer took on the debt of the entity getting bought up. Warner Bros. Discovery managed to pay down its debt by $5 billion during the previous quarter, and management putWhen the economy was in long-term expansion mode , companies were not shy about taking on large amounts of debt to finance operations and fuel growth.

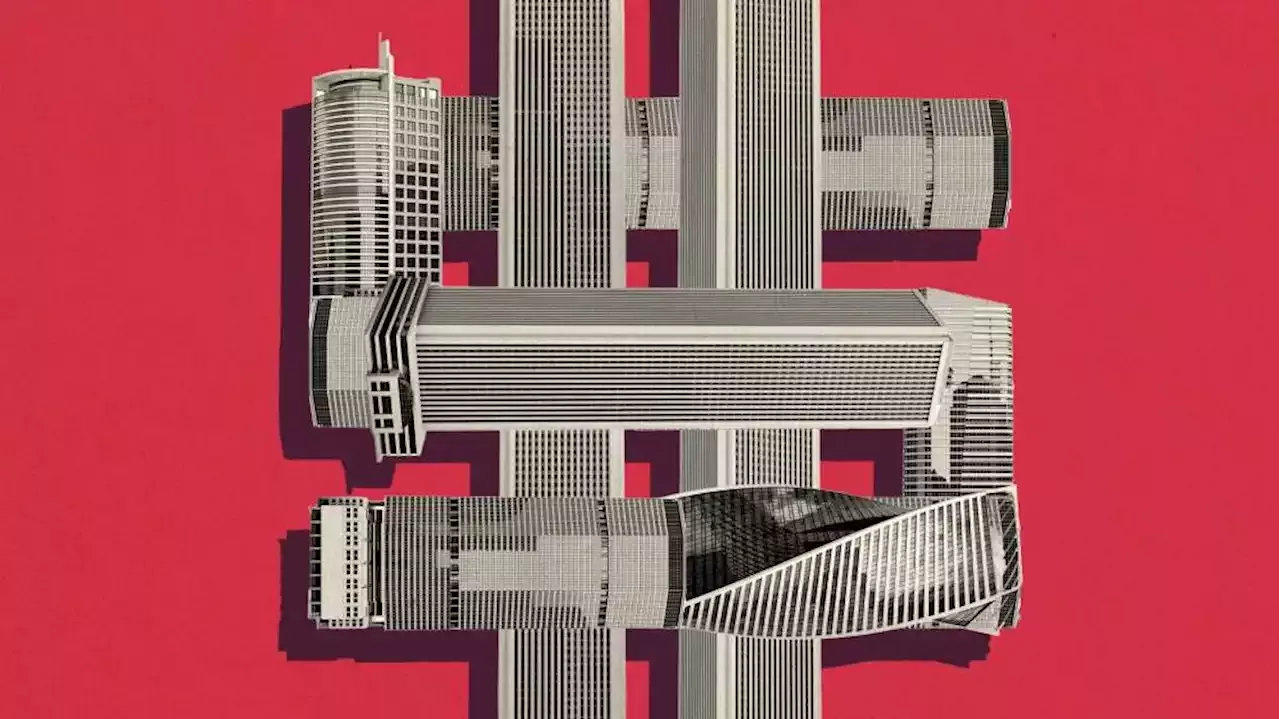

However, just because the amount of total debt is high, doesn’t mean that the company is in a bad financial position, and that’s where financial leverage comes in. While there are several ways to assess financial leverage, investors often look to debt-to-EBITDA and debt-to-equity to analyze balance sheet health among companies, media included.

A debt-to-equity ratio is a method of measuring a company’s financial leverage by dividing long-term debt by stockholders’ equity. It’s important when assessing the health of a company because it reveals how much of a company’s operations are being financed by debt versus wholly owned funds. When a company has a higher D/E ratio, it is often viewed as a riskier investment.

$Roku is all the way at the end and yet is leading the world into the streaming revolution.

MichelArouca

I believe debt is not the issue, it is whether or not the company that has debt can effectively manage it or whether it doesn't have the funds to do so.

When DC Stan's says box office doesn't matter. David Zaslav with 50+billion dept -

Hm