from Genesis’ books on Wednesday, was approached by FTX sister firm Alameda Research for lending earlier this year, according to a source familiar with the matter. B2C2 declined the offer for unspecified reasons.that he suspected Alameda Research was behind an attempted attack in 2019 on exchange Binance’s then-new futures platform.

Belgium-based market maker Kairon Labs heard about a month ago that FTX/Alameda was “secretly blowing up,” Willemen told CoinDesk. The information came to the firm from a close contact at a top Asian exchange. Despite not having concrete evidence, Kairon Labs decided to act. “While we have significantly reduced our exposure over the course of the week, we still have withdrawals that have yet to be processed,” the firm wrote at the time of the withdrawal pause, noting that the stuck assets represented less than 10% of Amber Group’s total trading capital.

B2C2Group KaironLabs FTX_Official AlamedaResearch BrandyBetz Why didn’t they raise the alarm.

Business Business Latest News, Business Business Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Market Analysis: Crypto Turns to an Oil-Patch Tradition to Right ItselfCrypto Market Analysis: Exchanges' newfound commitment to adopt proof-of-reserves measures echoes practices long followed by the oil and gas industry. GWilliamsJr_CMT reports GWilliamsJr_CMT Doesn't matter unless you can see proof of liabilities as well. GWilliamsJr_CMT Ironic....these exchanges are touting how secure they are by providing proof of reserves....which arr all backed by FIAT CURRENCY..created out of thin air by ...uhmm...the same entities that control Gov. ..the same gov people are begging to do the right thing 🤔😵💫 GWilliamsJr_CMT PoR (proof of reserves) - the next iteration of transparency that is long overdue

Market Analysis: Crypto Turns to an Oil-Patch Tradition to Right ItselfCrypto Market Analysis: Exchanges' newfound commitment to adopt proof-of-reserves measures echoes practices long followed by the oil and gas industry. GWilliamsJr_CMT reports GWilliamsJr_CMT Doesn't matter unless you can see proof of liabilities as well. GWilliamsJr_CMT Ironic....these exchanges are touting how secure they are by providing proof of reserves....which arr all backed by FIAT CURRENCY..created out of thin air by ...uhmm...the same entities that control Gov. ..the same gov people are begging to do the right thing 🤔😵💫 GWilliamsJr_CMT PoR (proof of reserves) - the next iteration of transparency that is long overdue

Read more »

XRP's 'Diamond Resistance' Plays Out Again: Crypto Market Review, November 14$XRP is on strong recovery path, thanks to the $40 billion inflow into the industry keddypendergras If you have any issue on crypto message me i can help you

XRP's 'Diamond Resistance' Plays Out Again: Crypto Market Review, November 14$XRP is on strong recovery path, thanks to the $40 billion inflow into the industry keddypendergras If you have any issue on crypto message me i can help you

Read more »

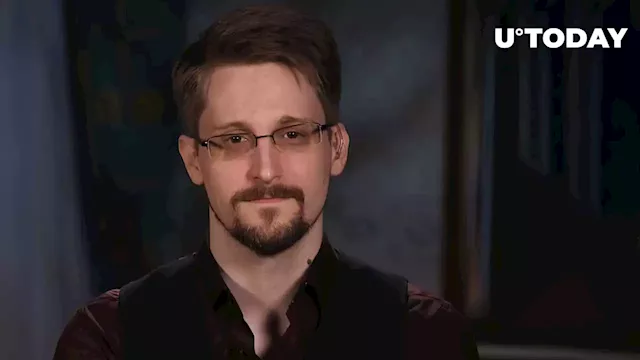

Edward Snowden Reveals His Crypto Market Prediction.Snowden shares his prediction with the crypto community but says he has no idea what he's doing

Edward Snowden Reveals His Crypto Market Prediction.Snowden shares his prediction with the crypto community but says he has no idea what he's doing

Read more »

Solana's 80 Million Curse Reaches Markets: Crypto Market Review, November 15$ETH is on the rise, while $SOL is battling millions of coins released from staking after FTX crash

Solana's 80 Million Curse Reaches Markets: Crypto Market Review, November 15$ETH is on the rise, while $SOL is battling millions of coins released from staking after FTX crash

Read more »

Ethereum Turns into First Profitable Blockchain from Top 10 of Crypto MarketThanks to burning mechanism, Ethereum is slowly turning into profitable network Uniswap neeeed to fix this now

Ethereum Turns into First Profitable Blockchain from Top 10 of Crypto MarketThanks to burning mechanism, Ethereum is slowly turning into profitable network Uniswap neeeed to fix this now

Read more »