Charles Schwab Corp. is well-known as the premier discount broker in the U.S., and some may not realize that it’s actually a savings and loan holding company.

Schwab’s SCHW main banking subsidiary is Charles Schwab Bank SSB, an insured depository institution based in Westlake, Texas. The bank had $349 billion in total assets as of Dec. 31, while Charles Schwab Corp. had $552 billion in total assets. An outflow of deposits drove the sale of securities that SVB Financial Group SIVB announced last week, before that company’s main subsidiary Silicon Valley Bank of Santa Clara, Calif., was closed by state regulators on Friday and handed over to the Federal Deposit Insurance Corp. SVB’s problems sprang from its focus on clients in the venture capital industry and a balance sheet heavily concentrated in long-term bonds that had lost value as interest rates rose.

On the holding company level, Schwab’s net revenue for 2022 totaled $15.57 billion. Here’s how that was broken down:So the company’s banking business is critically important. Brokerage clients’ cash is kept in bank sweep accounts, and clients who use margin to invest pay fees and interest on borrowings.

Shut it all down, all Schwab's companies.

Business Business Latest News, Business Business Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Charles Schwab moves to reassure investors it has plenty of liquidity and business is performing ‘exceptionally well’Charles Schwab Corp. moved Monday to reassure investors that it has plenty of liquidity and does not need to sell any of its held-to-maturity securities over... Jesus, not reassuring 🤣 The old 'we have plenty of liquidity trick'

Charles Schwab moves to reassure investors it has plenty of liquidity and business is performing ‘exceptionally well’Charles Schwab Corp. moved Monday to reassure investors that it has plenty of liquidity and does not need to sell any of its held-to-maturity securities over... Jesus, not reassuring 🤣 The old 'we have plenty of liquidity trick'

Read more »

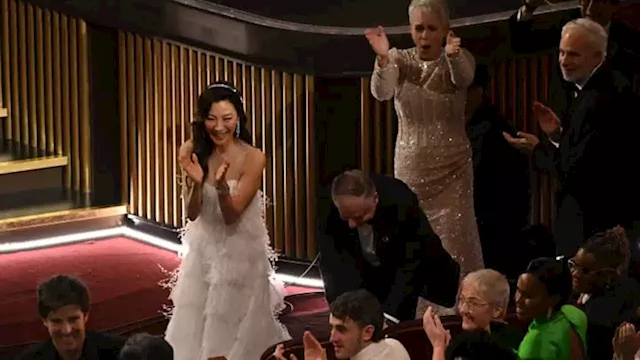

5 things to know before the stock market opens MondayHere are the most important news items that investors need to start their trading day. What Oscar’s have to do with markets opening ? Fake marketing gambling I have lost $10,000 without any profit I hate seeing this on social media

5 things to know before the stock market opens MondayHere are the most important news items that investors need to start their trading day. What Oscar’s have to do with markets opening ? Fake marketing gambling I have lost $10,000 without any profit I hate seeing this on social media

Read more »