Right now, $250,000 seems to be the number on everyone’s minds. That’s the Federal Deposit Insurance Corporation’s standard limit, meaning any bank deposits up to that amount are protected by the independent government agency. Before the recent collapse of Silicon Valley Bank and Signature Bank, most Americans were not worried about insurance limits on banks, since almost all US banks are backed by the FDIC. But now there’s growing support for raising that insurance cap.

In the case of banks, that means they will be more likely to take on riskier bets if they know they are more protected, raising the possibility of a repeat of this month’s chaos. Officials will have to take this tradeoff into account when considering policy changes, especially if scrapping the limit altogether. The term has been thrown around lately, after the government intervened in the banking meltdown to support the failed banks’ depositors.

Why should this limit be arbitrarily raised? If you want life insurance, you need to pay for it. If you want twice as much coverage, you must pay even more. Why should bank customers have their money insured but not have to pay for it? Why should tax payers have to pay for…

Remember why this happened? JOE BIDEN!

Dodd Frank protections need to be reinstated now ! The raise from 50 billion to 250 billion was stupid and possibly premeditated by banks to commit crimes !

Business Business Latest News, Business Business Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

![]() Fight Brewing Between Silicon Valley Bank's Former Parent Company and FDICA legal fight is ramping up between the FDIC and the former parent company of Silicon Valley Bank. SVB Financial said the banking regulator took 'improper actions' and can't access its money held at its former unit. Dov Kleiner, partner at Kleinberg, Kaplan, Wolff & Cohen, P.C., discusses the key takeaways from the bankruptcy hearing. Plus, reactions to Bloomberg reporting Silicon Valley Bank loans to insiders tripled to $219 million before being overtaken by regulators. Thanks a millon FDICgov KleinbergKaplan DovKleiner 🐖💨

Fight Brewing Between Silicon Valley Bank's Former Parent Company and FDICA legal fight is ramping up between the FDIC and the former parent company of Silicon Valley Bank. SVB Financial said the banking regulator took 'improper actions' and can't access its money held at its former unit. Dov Kleiner, partner at Kleinberg, Kaplan, Wolff & Cohen, P.C., discusses the key takeaways from the bankruptcy hearing. Plus, reactions to Bloomberg reporting Silicon Valley Bank loans to insiders tripled to $219 million before being overtaken by regulators. Thanks a millon FDICgov KleinbergKaplan DovKleiner 🐖💨

Read more »

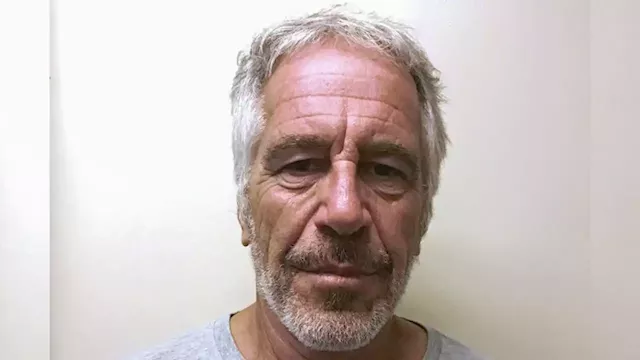

JPMorgan, Deutsche Bank must face lawsuits over Jeffrey Epstein ties, judge says | CNN BusinessJPMorgan Chase and Deutsche Bank must face lawsuits that accuse them of enabling Jeffrey Epstein's sex trafficking, a US judge said Monday. Think about what this means for a minute. Not only were the highest political/government figures taking rides with him to his island, but some of the biggest financial institutions were in bed with him. But yeah, you're crazy if you say the world is run by pedophiles. Follow the money. The current assault on Trump is to distract you from the banking crisis, Epstein’s Island rapists and the impending WWIII ImpeachBidenNow

JPMorgan, Deutsche Bank must face lawsuits over Jeffrey Epstein ties, judge says | CNN BusinessJPMorgan Chase and Deutsche Bank must face lawsuits that accuse them of enabling Jeffrey Epstein's sex trafficking, a US judge said Monday. Think about what this means for a minute. Not only were the highest political/government figures taking rides with him to his island, but some of the biggest financial institutions were in bed with him. But yeah, you're crazy if you say the world is run by pedophiles. Follow the money. The current assault on Trump is to distract you from the banking crisis, Epstein’s Island rapists and the impending WWIII ImpeachBidenNow

Read more »