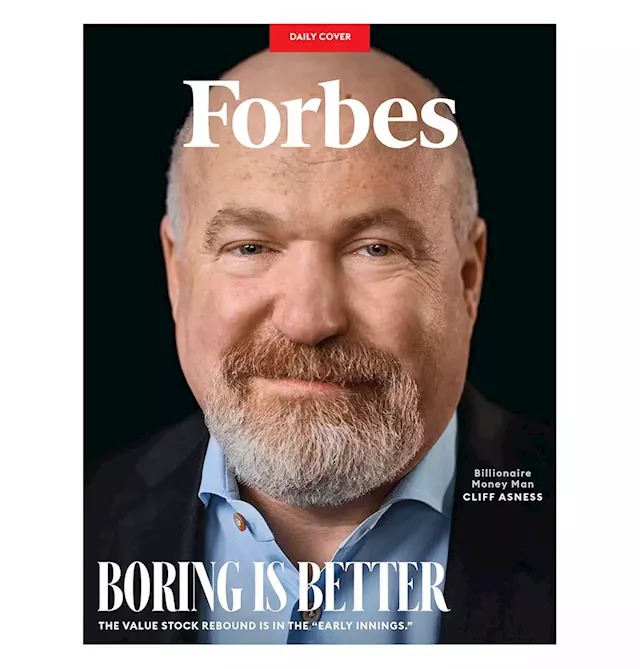

For a depressingly protracted period the value-conscious portfolio managers at AQR, which Asness, 56, cofounded in 1998, lost ground to competitors chasing hot growth stocks. Then came last year’s stock market rout. As the air exited inflated tech stocks, AQR funds became winners.

Value stocks are the shares of sluggish, unexciting companies that only contrarians love—like Stellantis, the Chrysler-Dodge-Fiat car company. The market darlings are fast-growing and sexy. Ferrari, for example. Growth stocks should trade at a premium to boring stocks. But how much of one? Expensive stocks, as AQR defines that universe, are trading at triple the multiple of earnings that cheap stocks trade at. Asness thinks they ought to be at only twice the multiple.

“A three-year super-tough period is not long statistically but is gigantically long emotionally,” Asness says. “The world fires people for losing money for three to five years.” When value lagged, the case for buying it, at least in theory, got stronger and stronger. But so did a client’s urge to flee. Asness tracks what he calls the value spread, the degree to which value stocks have gotten too cheap relative to growth stocks.

A couple years shy of the millennium the threesome, along with a fourth Goldman alumnus, opened AQR . Affiliated Managers Group, a publicly traded confederation of portfolio managers, owns a fourth of the business. AQR insiders own the rest, Asness with the lion’s share.

baldwinmoney Invest in excellent companies that make lots of money and have a large moat........that's it.

Business Business Latest News, Business Business Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

How To Beat The Market With Boring StocksThe shares of sleepy companies have recently bested those of exciting ones. This is just the beginning of a big trend, says Cliff Asness, the billionaire cofounder of AQR.

How To Beat The Market With Boring StocksThe shares of sleepy companies have recently bested those of exciting ones. This is just the beginning of a big trend, says Cliff Asness, the billionaire cofounder of AQR.

Read more »

How To Beat The Market With Boring StocksThe shares of sleepy companies have recently bested those of exciting ones. This is just the beginning of a big trend, says Cliff Asness, the billionaire cofounder of AQR.

How To Beat The Market With Boring StocksThe shares of sleepy companies have recently bested those of exciting ones. This is just the beginning of a big trend, says Cliff Asness, the billionaire cofounder of AQR.

Read more »

BioNTech stock falls as earnings beat expectations, but show falling demand for COVID-19 vaccinesThe U.S.-listed shares of BioNTech SE fell 2.7% in premarket expectations, as profit and revenue beat expectations but fell from a year ago due to lower... I wonder why...

BioNTech stock falls as earnings beat expectations, but show falling demand for COVID-19 vaccinesThe U.S.-listed shares of BioNTech SE fell 2.7% in premarket expectations, as profit and revenue beat expectations but fell from a year ago due to lower... I wonder why...

Read more »