For traders accustomed to treating such signals as sacrosanct, the message was obvious. Gone were the days when inflation was their main menace. Rates showed stress in the financial system made a recession inevitable.

“Each day that there isn’t a banking crisis is another day indicating that the current pricing doesn’t make sense, but it’s going to take a while,” said Bob Elliott, chief investment officer of Unlimited Funds, who worked for Bridgewater Associates for 13 years. Meanwhile, daily fluctuations in two-year Treasury yields erupted last month into the widest in 40 years. The ICE BofA MOVE Index, which tracks expected swings in Treasuries as measured by one-month options, climbed in mid-March to its highest since 2008, opening the biggest gap between stock and bond volatility in 15 years as well. Even after things calmed a bit, the gauge remains more than double its average over the past decade.

Phrased differently: “The bond market has gone berserk,” says Dominique Dwor-Frecaut, a senior market strategist at the research firm Macro Hive Ltd., who previously worked in the New York Fed’s markets group. “For once, I’m on the side of equity markets. I don’t see a recession coming.” Of course, less than a month out from the failure of three banks and the government-sponsored bailout of a fourth in Europe, it’s too early for optimism, even as Treasury Secretary Janet Yellen says the system is showing signs of stabilization. Harley Bassman, the former Merrill managing director who created the MOVE index in 1994, said it’s not unusual for the VIX — the equity volatility benchmark—and the MOVE to flash different signals, but history shows it doesn’t last.

“The market is extremely illiquid. What this reminds me of is the 2008-2009 illiquidity in the bond markets. It’s kind of similar. You cannot afford to get stuck with a bad position,” said Vineer Bhansali, founder of LongTail Alpha LLC and the former head of analytics for portfolio management at Pacific Investment Management Co. “The Treasury market is a roach motel right now. You can get in but you can’t get out. So be very careful.

Business Business Latest News, Business Business Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

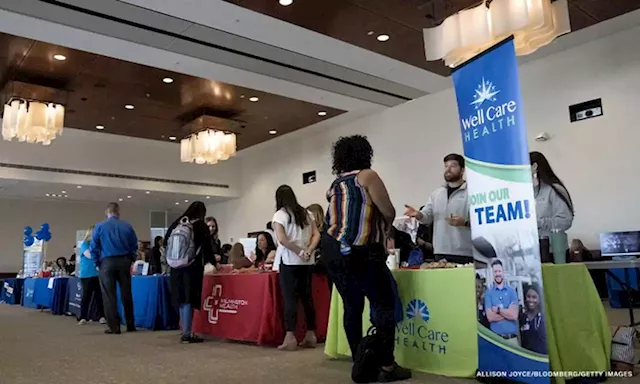

A labor market cooldown: US economy added just 236,000 jobs in MarchUS employers added just 236,000 jobs in March, coming in below expectations and indicating that the labor market is cooling off amid the Federal Reserve's yearlong rate-hiking campaign to chill inflation.

A labor market cooldown: US economy added just 236,000 jobs in MarchUS employers added just 236,000 jobs in March, coming in below expectations and indicating that the labor market is cooling off amid the Federal Reserve's yearlong rate-hiking campaign to chill inflation.

Read more »